Disclaimer and Risk Warning: This content is for general information and educational purposes only, without representation or warranty. It should not be construed as financial, legal, or other professional advice, nor intended to recommend purchasing any specific product or service. You should seek advice from appropriate professional advisors.

Welcome to PancakeSwap Infinity

PancakeSwap Infinity is the next evolution of decentralized trading —designed for maximum flexibility and capital efficiency. It introduces advanced features like customizable liquidity pools, automated trading logic through Hooks, and multiple pool types to fit every LP strategy.

Whether you want to swap tokens, provide liquidity, create pools, or experiment with hooks, this guide walks you through each core feature step-by-step.

1: Swapping on PancakeSwap Infinity

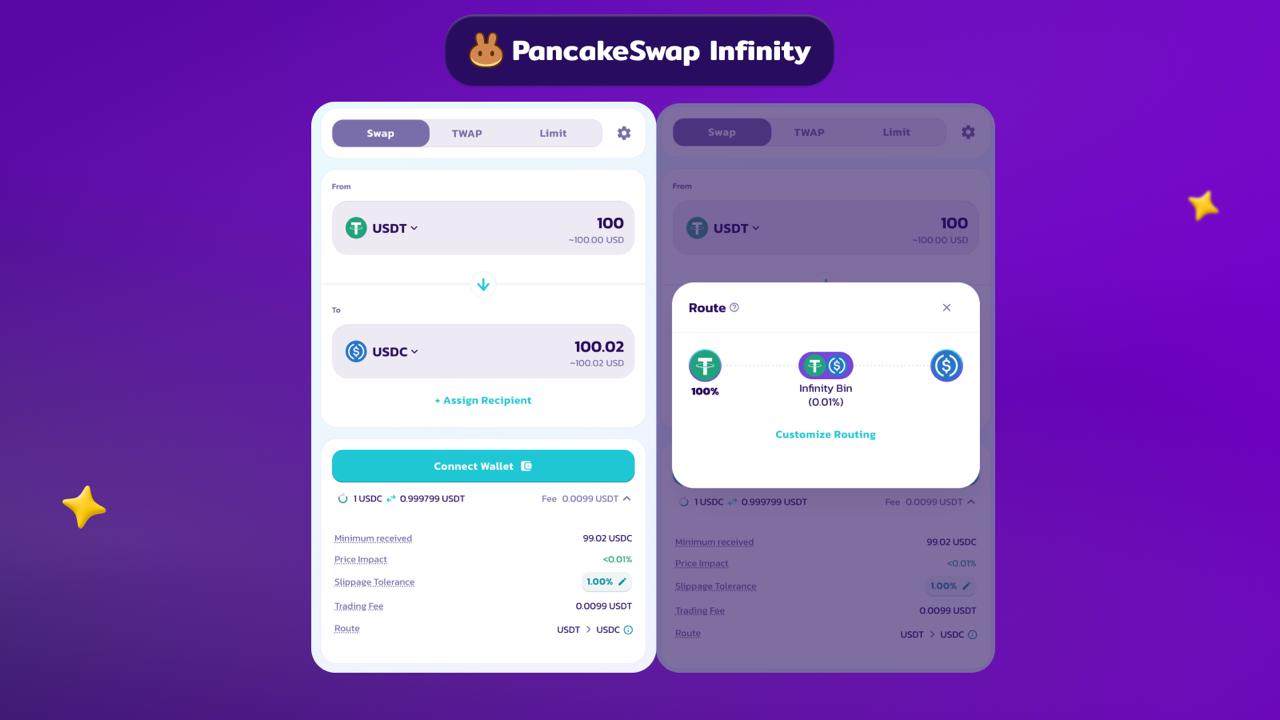

Swapping on Infinity works just like a regular swap on PancakeSwap. There are no extra steps—PancakeSwap’s Universal Router automatically finds the best rate, whether from a standard v2/v3 pool or an Infinity Hook-enabled pool. If an Infinity pool offers the best route, your trade is automatically routed through it.

How to Swap on PancakeSwap Infinity:

1. Visit PancakeSwap – pancakeswap.finance

2. Connect Wallet – Click “Connect Wallet” and choose your provider

3. Select Tokens – Choose your “From” and “To” tokens (e.g., USDT → USDC)

4. Enter Amount – Input the amount you want to swap

5. Review Swap Details – If an Infinity route is used, it’ll be shown (e.g., “Route: Infinity”)

6. Confirm & Execute – Click “Swap” and approve the transaction

7. Done! – Swapped tokens will appear in your wallet

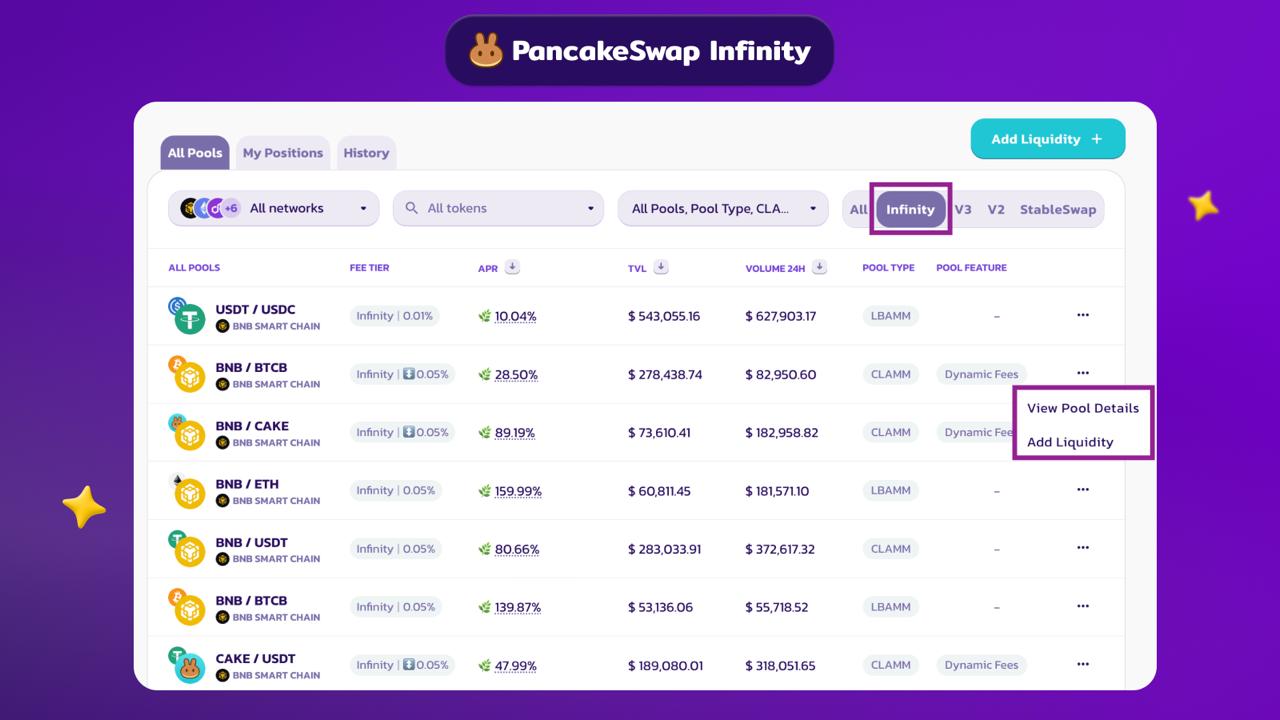

2: Adding Liquidity in PancakeSwap Infinity

Providing liquidity in PancakeSwap Infinity earns you a share of trading fees when your liquidity is used. PancakeSwap Infinity supports two pool types: CLAMM (Concentrated Liquidity AMM) & LBAMM (Liquidity Book AMM).

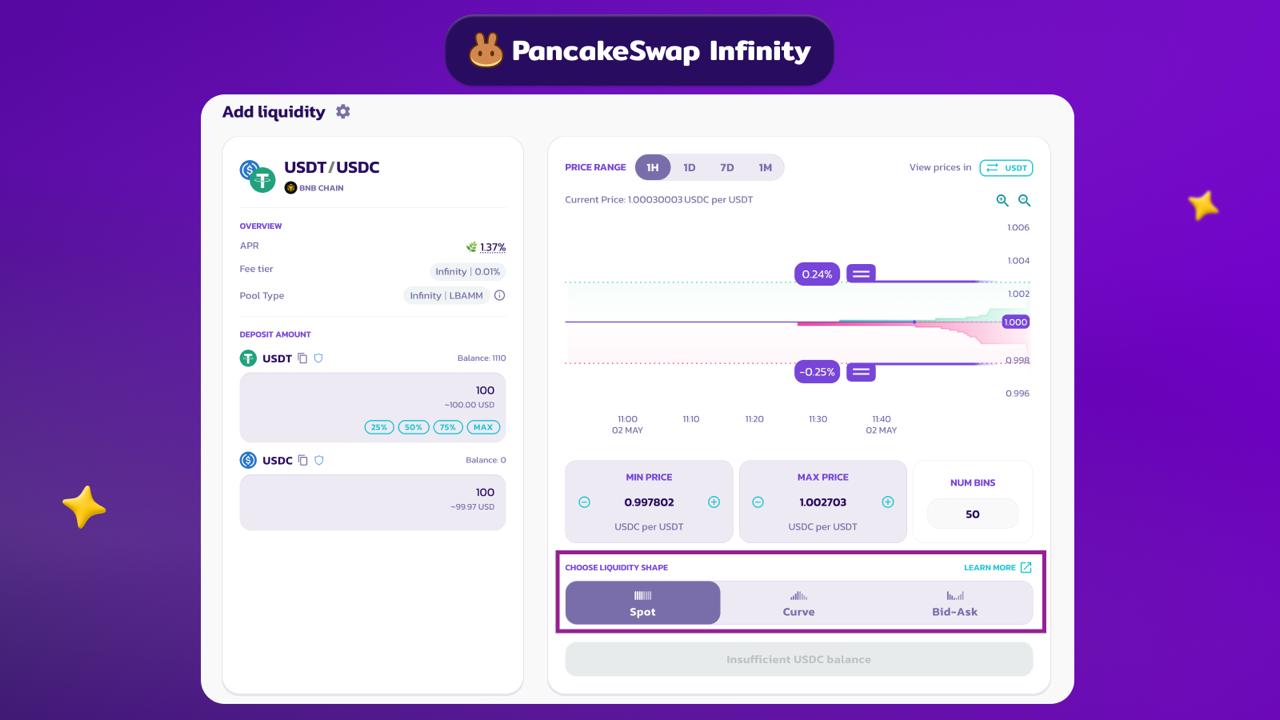

2.1 Adding Liquidity to LBAMM

LBAMM pools are ideal for passive liquidity providers, especially on low-volatility pairs.

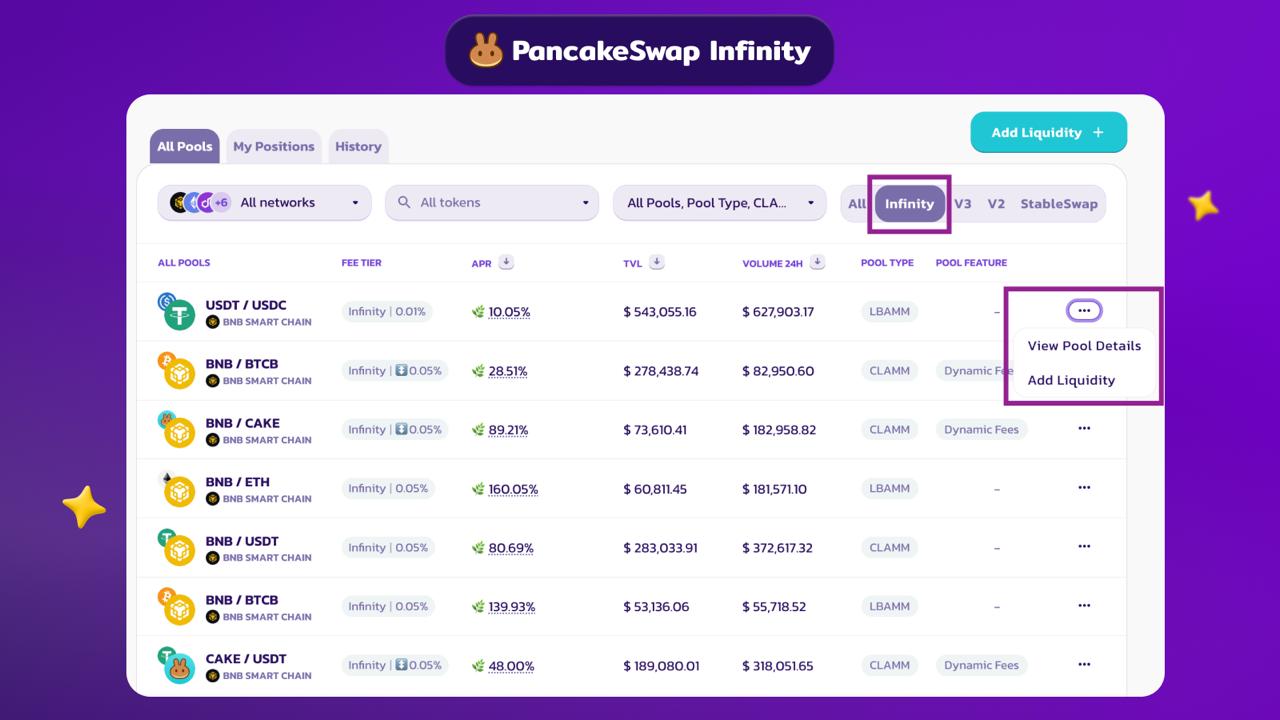

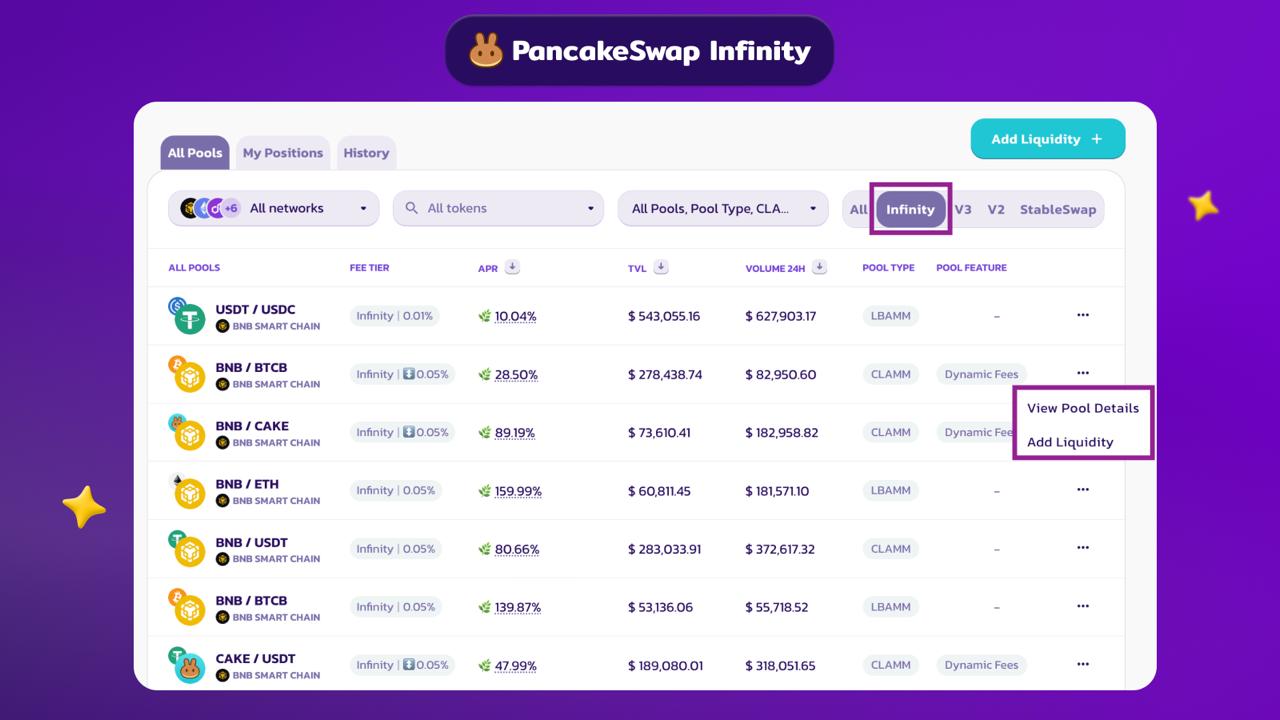

1. Go to Liquidity Page – Navigate to “Liquidity” on PancakeSwap

2. Enable Infinity View – Toggle “Infinity” to view Hook-enabled pools

3. Choose Pool – Select an LBAMM pool (e.g., USDT/USDC)

4. Click “...” → Add Liquidity or directly click on the pool you want to add liquidity to view more details

5. Enter Amounts – Input the amount for each token, select price range

6. Choose Liquidity Shape – Spot, Curve, or Bid-Ask

Select how you want to distribute your liquidity based on your market expectations:

- Spot – Distributes liquidity evenly across all price bins. Ideal for balanced exposure and predictable coverage when market direction is uncertain.

- Curve – Concentrates more liquidity near the current price and tapers off further away. Best when you expect low volatility and want to maximize fees from frequent trades near the market price.

- Bid-Ask – Places less liquidity near the current price and more further out. Suited for high-volatility environments where you aim to capture fees from larger, directional price movements.

7. Confirm Transaction – Approve via your wallet

8. Receive LP Tokens – ERC-20 tokens will represent your position

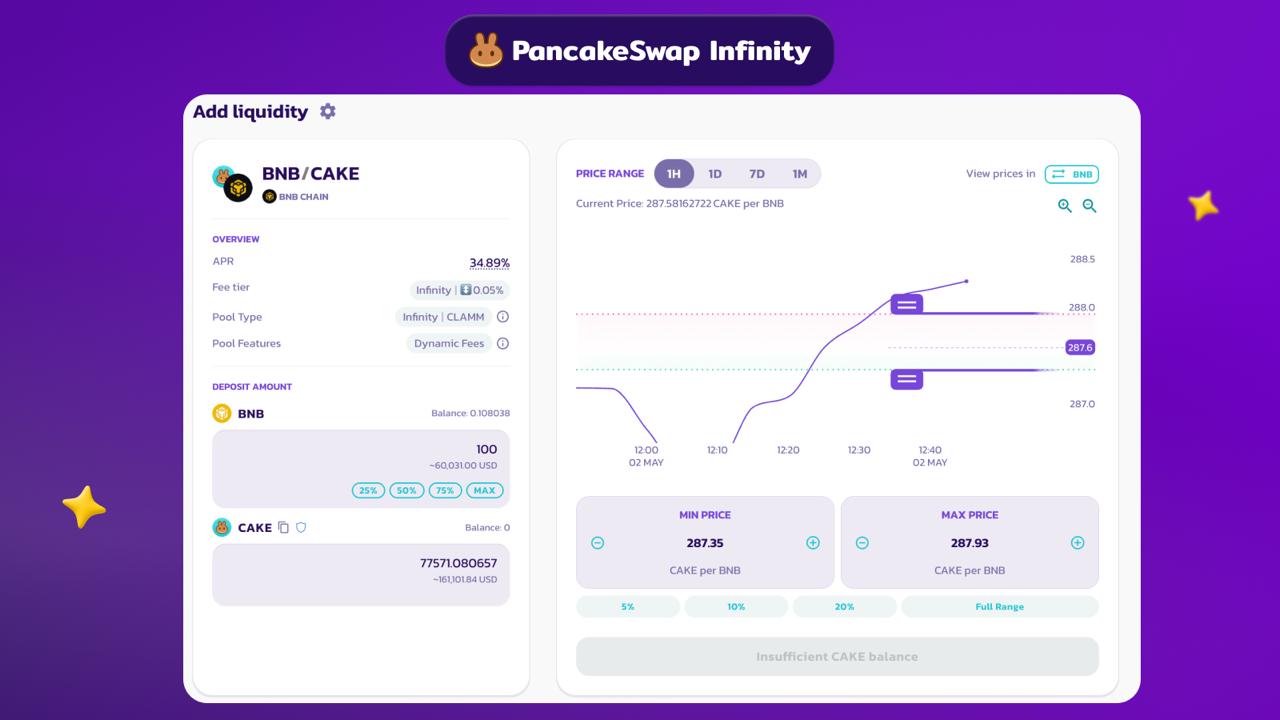

2.2 Adding Liquidity to CLAMM (with Dynamic Fee Hook)

CLAMM pools let you provide liquidity in custom price ranges, offering high capital efficiency. This example uses a Dynamic Fee Hook, which adjusts fees automatically based on market conditions.

1. Go to Liquidity Page – Navigate to “Liquidity” and enable the “Infinity” tab.

2. Choose Pool – Select a CLAMM pool (e.g., BNB/CAKE with Dynamic Fee Hook), click “...” → “Add Liquidity”. or directly click on the pool you want to add liquidity to view more details

3. Input Token Amounts – Input the amount of each token, select price range

4. Confirm Transaction – Approve the transaction in your wallet.

5. Receive LP Tokens – You'll receive Non-fungible (NFT) representing your position.

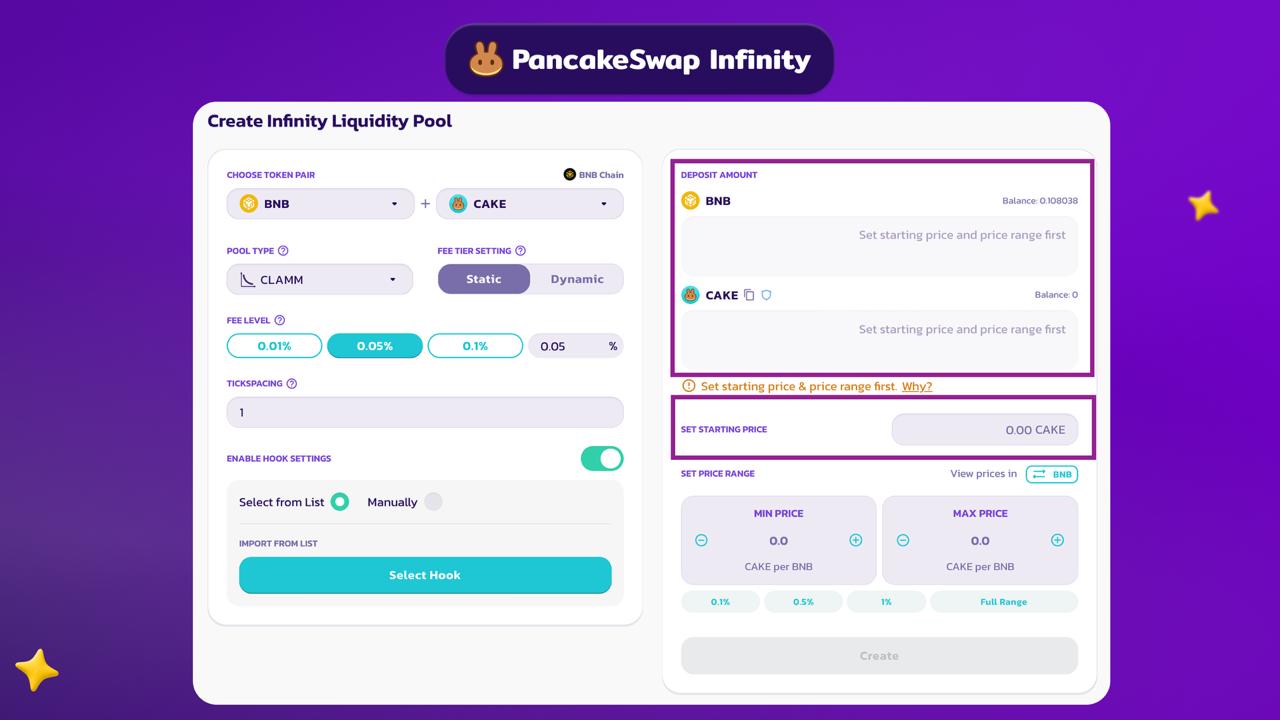

3: Creating a Liquidity Pool on PancakeSwap Infinity

Want full control? Creating your own pool lets you set fees, ranges, hooks, and pool types.

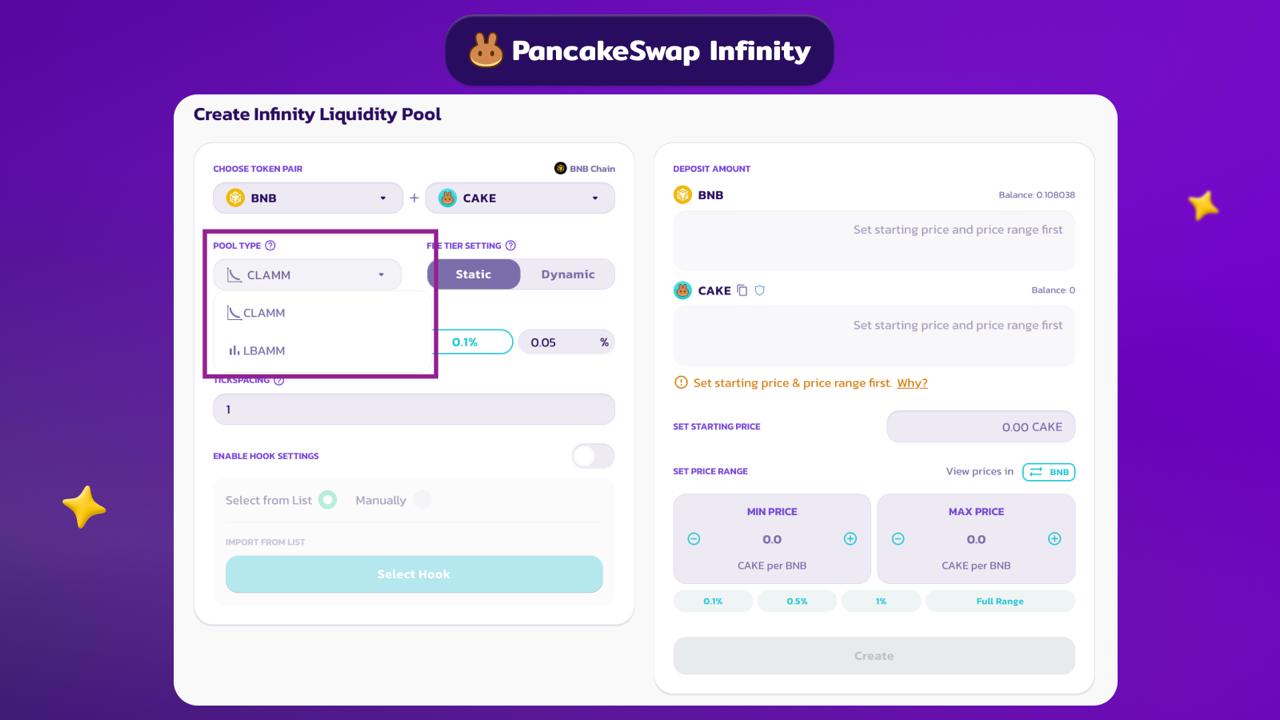

1. Go to the Pool Creation Page: Navigate to the Create Infinity Liquidity Pool.

2. Select Token Pair: Choose the two tokens you want to pair (e.g., BNB and CAKE).

3. Choose Pool Type: PancakeSwap Infinity supports two pool types. Select the one that fits your liquidity strategy:

- CLAMM (Concentrated Liquidity AMM)

Ideal for active LPs looking for greater control over capital efficiency. Liquidity is provided within a specific price range. Learn more about CLAMM

- LBAMM (Liquidity Book AMM)

Designed for passive LPs and low-volatility pairs. Liquidity is distributed across price bins, with 0 price impact within each bin. Learn more about LBAMM

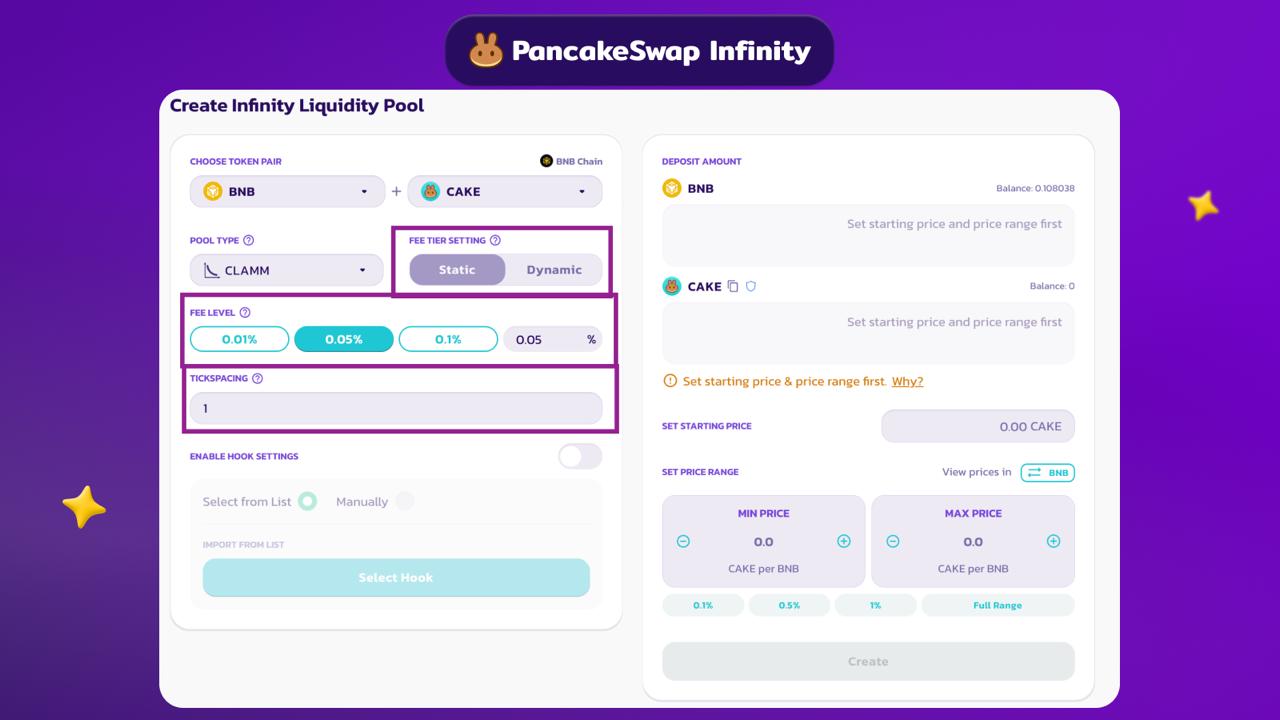

4. Set Fee Tier: Choose how fees are handled in your pool:

- Static Fee – Fixed trading fee (e.g., 0.01%, 0.05%, 0.1%, or custom).

- Dynamic Fee – Adjusts automatically based on market conditions using the Dynamic Fee Hook. Helps protect LPs from impermanent loss and aligns incentives. Learn more about Dynamic Fee Hook

5. Configure Tick Spacing (CLAMM only)

- Tick = 0.01% price movement

- Smaller tick spacing = higher precision but more gas usage

- Larger tick spacing = lower gas cost, less precision

- Example: With Tick Spacing of 3, valid price ticks are ..., -6, -3, 0, 3, 6…

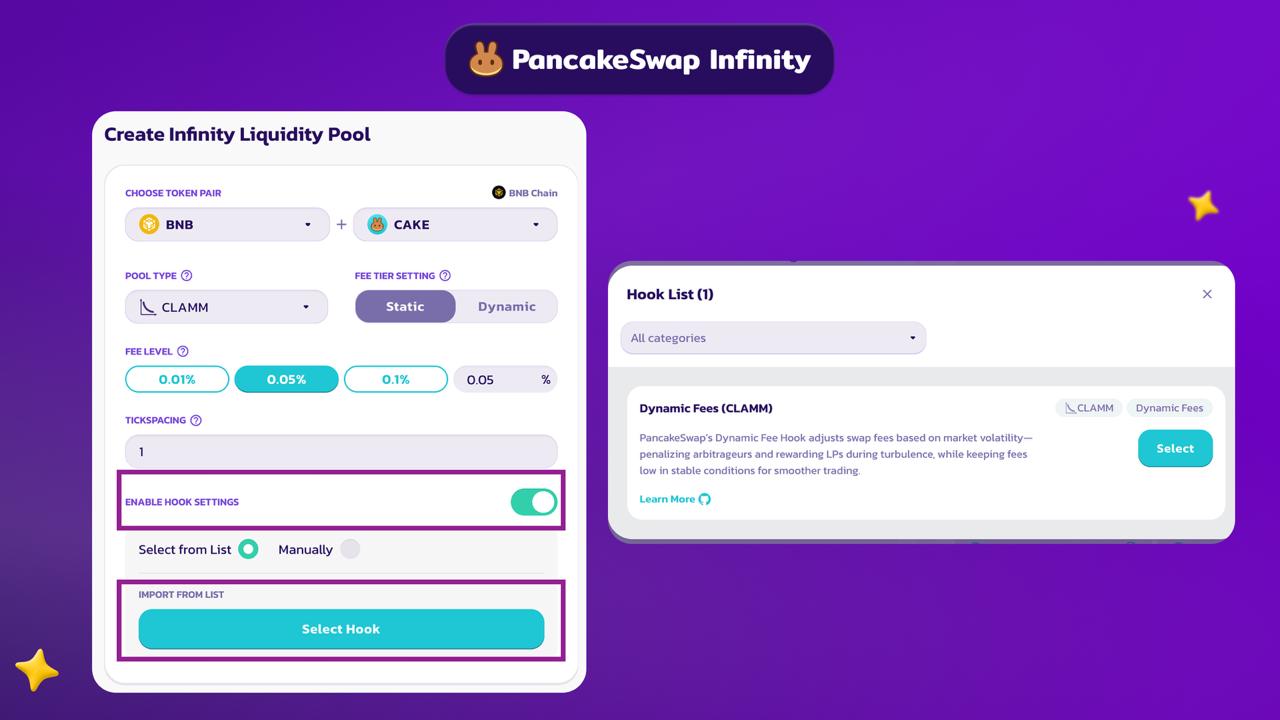

6. Add a Hook (Optional)

- Customize your pool’s behavior with Hooks—modular components that adjust how your pool operates (e.g., fees, liquidity logic, and more).

- Click “Select from list” to choose from PancakeSwap’s whitelisted Hooks or enter hook address manually

7. Set Starting Price & Range

- Initialize the pool by choosing a starting price.

- Set your initial price range for liquidity.

- ⚠️ This step requires a one-time gas-intensive transaction.

- 🚫 Note: Fee-on-transfer and rebasing tokens are not supported.

8. Enter Deposit Amount

- Input the amount of each token you want to add as liquidity.

- These tokens will be used for trades in your new pool.

9. Confirm & Finalize

- Review all details and click “Create”.

- Approve the transaction in your wallet.

- Once confirmed, your pool and liquidity position will be active.

Your Infinity pool is now live!

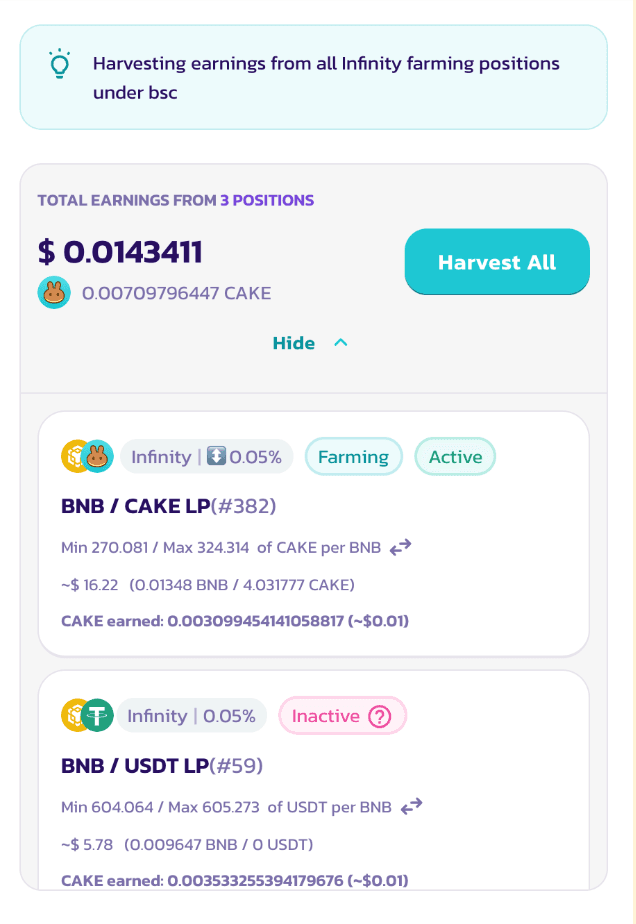

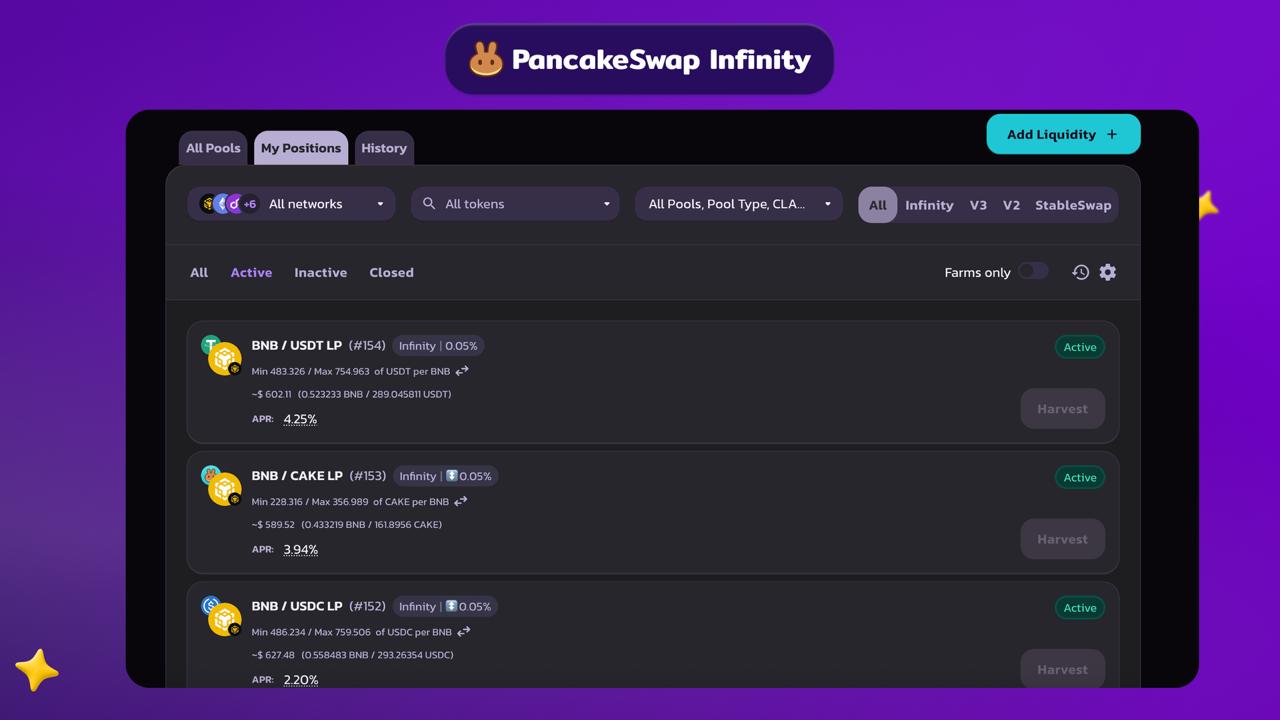

4. How to Farm on PancakeSwap

Farming on Infinity is seamless and requires no extra staking steps. Once you add liquidity to an eligible Infinity Pool, you automatically start earning trading fees and Farming rewards—if your position is in range.

1. Add Liquidity to an Eligible Pool: Go to the “Liquidity” section on PancakeSwap, switch to the “Infinity” view, and add liquidity to any pool that supports Farming (e.g.,BNB/CAKE).

2. Automatically Start Earning: Once your liquidity is added, you’ll automatically begin earning:

- Trading fees from swaps routed through your pool

- Farming rewards if your position is within the active trading range

3. Track and Harvest Rewards

- Rewards are distributed at the end of each epoch: 00:00 UTC, 08:00 UTC, 16:00 UTC

- Users can claim rewards after 1-hour dispute period is over after each epoch

- Go to “My Positions” to view your earnings.

- Click “Harvest” to claim your Farming rewards after each epoch (8-hour cycle).

- Rewards across all farms can be claimed in a single transaction

- Rewards are proportional to the fees your position earns during that period.

- Unclaimed rewards roll over—no earnings are lost.

Farming Tip: Only in-range liquidity earns rewards. Monitor your position range to maximize returns. Learn more in the documentation

By following this guide, you are now equipped to unlock the full potential of PancakeSwap Infinity—whether swapping tokens, providing liquidity, creating pools, or developing next-level trading auto

Keep it ∞ The Chefs