In celebration of PancakeSwap's fourth anniversary, we're excited to introduce our first-ever Prediction Telegram Bot - Beta for BNB predictions on the BNB Chain. This new bot brings the excitement of our prediction market directly to your favorite messaging app, making it easier and more convenient to participate. To mark this special occasion, we're giving away $4,444 in rewards on September 22nd, our fourth birthday!

A New Way to Predict: Bringing Predictions to Your Fingertips

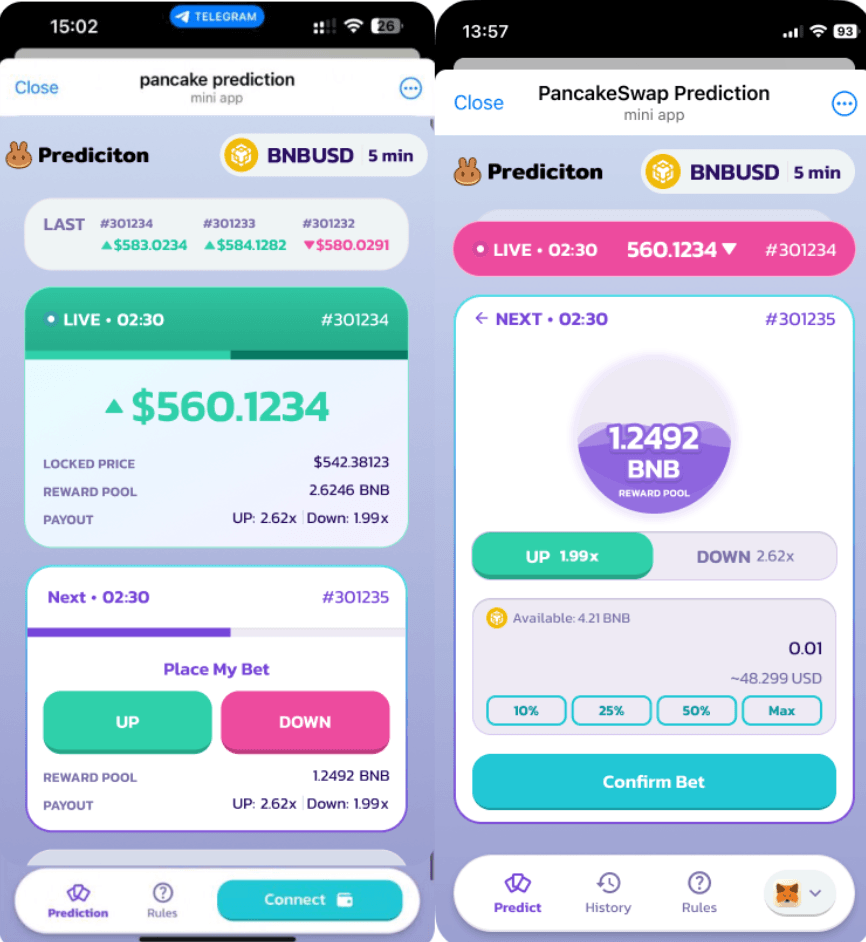

PancakeSwap prediction has always been a community favorite, allowing users to forecast BNB prices every 5 minutes. Now, with our Prediction Telegram Bot, you can enjoy the same features as our web version, but with added convenience and accessibility. Whether you’re on the go or prefer Telegram, you have more ways than ever to engage with the market.

Key Features:

- Supported Token: BNB on BNB Chain

- Round Duration: 5 minutes

- Fees: 3% of each round’s total pot goes to the treasury, supporting buybacks, burns, and future development

How to Connect Your Wallet?

1. On Desktop You may only use a mobile wallet on your phone with Desktop Telegram mini app by scanning the QR code either via MetaMask or WalletConnect. You will need to confirm transactions and signings on your mobile.

2. On Mobile Use MetaMask or WalletConnect: You will be directed to MetaMask for transactions and signing. After signing, you will need to switch back to Telegram to continue.

For a detailed guide on how to connect your wallet, please refer to this doc: https://docs.pancakeswap.finance/products/prediction/prediction-mini-app

How the Prediction Telegram Bot Works:

At the initial launch, the Prediction Telegram app won't be available in the Telegram app store. Instead, users can access the product through a direct web link and by interacting with the Telegram bot. This means you'll need to use the provided link or bot to get started with the prediction features. (Please note that the bot is currently in its beta phase.)

1. Stay Mobile: Open the PancakeSwap Prediction Telegram Bot on Telegram.

2. Predict: Choose " Up" if you expect the price to rise or " Down" if you think it will fall. Enter your prediction amount and wait for the round to close. If your prediction is correct, you’ll earn a share of the prize pool, multiplied by the round’s multiplier. (The minimum amount you can predict is 0.001 BNB.)

Example: If BNB is currently priced at $520 and you predict it will rise in the next 5 minutes, open the Telegram bot, click " Up," and enter your amount. If the price increases to $525, you'll win a share of the prize pool based on your prediction.

Just like our web version, the Telegram bot offers an intuitive and straightforward way to place predictions —no need to navigate multiple tabs or log in separately.

[ENDED] Celebrate with Us: Win Your Share of $4,444 on September 22nd

Join our 4th Birthday campaign for a chance to win from our $4,444 reward pool! Here’s how you can participate:

- Campaign Duration: 22 September (00:00 UTC to 23:59 UTC)

- Total Reward Pool: $4,444 USDT on the BNB Chain

- Eligibility: Only predictions placed via the Prediction Telegram bot are eligible; web version predictions do not count.

Part 1: Lucky Reward ($3,333)

- Qualification: Place predictions totaling at least $5 via the Prediction Telegram bot. Multiple predictions can be used to meet this requirement. (The minimum amount you can predict in each round is 0.001 BNB)

- Prize: 100 random users will each receive $33.33.

Part 2: Top Predictors Pool ($1,111)

- Qualification: Place predictions totaling at least $500 via the Prediction Telegram bot. Multiple predictions can be used to meet this requirement.

- Prize: The top 3 users with the highest net winnings during the campaign will share $1,111.

- Rank 1: $555

- Rank 2: $333

- Rank 3: $223

Track Your Progress for Part 2: Monitor your "Net Winning" ranking on the leaderboard here: https://dune.com/pancakeswap/pancakeswap-prediction-tg-bot-campaign

Terms & Conditions:

- Only predictions made through the Telegram bot on September 22nd are eligible for rewards. Predictions via the PancakeSwap website will not count for this campaign.

- To qualify for rewards, users must meet the minimum volume requirements ($5 for Part 1 Lucky Rewards, $500 for Part 2 Top Predictors Pool).

- Rewards will be distributed in USDT on the BNB Chain within two weeks after the campaign concludes.

- We reserve the right to modify or cancel the campaign mechanics or rules at any time without prior notice.

- In any dispute, PancakeSwap will make the final decision regarding the campaign.

Start Predicting Today!

The PancakeSwap Prediction Telegram bot is now live and ready for you to start predicting. Get in on the fun! Our Pancake4ever birthday celebration is in full swing. Dive into the festivities and discover all the thrilling details here. Come celebrate with us!