Providing liquidity on PancakeSwap Infinity allows you to earn a share of trading fees generated by the pools you contribute to. With the introduction of advanced Automated Market Maker (AMM) designs like CLAMM and LBAMM, PancakeSwap Infinity gives you the flexibility to choose a liquidity strategy that fits your risk profile and trading preferences.

In this guide, you’ll learn how to add liquidity to both types of pools on PancakeSwap Infinity.

What Is PancakeSwap Infinity?

Infinity is the latest evolution of PancakeSwap’s AMM infrastructure, designed to maximize capital efficiency and flexibility. It supports advanced trading logic via Hooks and offers two core pool types:

- CLAMM: Concentrated Liquidity AMM — ideal for active LPs who want to define custom price ranges for their capital.

- LBAMM: Liquidity Book AMM — designed for passive LPs, with liquidity spread across price bins and minimal active management.

Providing liquidity in PancakeSwap Infinity earns you a share of trading fees when your liquidity is used. PancakeSwap Infinity supports two pool types: CLAMM (Concentrated Liquidity AMM) & LBAMM (Liquidity Book AMM).

Step-by-Step: Adding Liquidity to PancakeSwap Infinity

1. Adding Liquidity to LBAMM (Liquidity Book AMM)

LBAMM pools are ideal for passive liquidity providers, especially on low-volatility pairs.

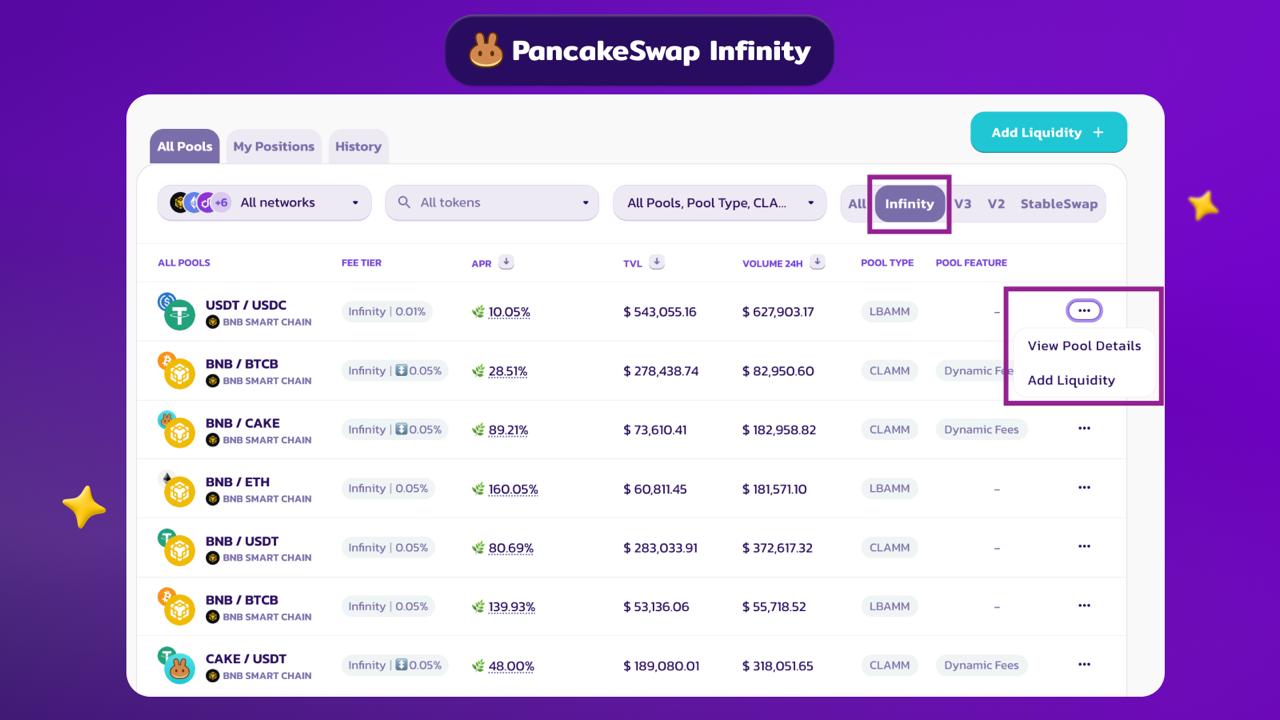

1. Go to Liquidity Page – Navigate to “Liquidity” on PancakeSwap

2. Enable Infinity View – Toggle “Infinity” to view Hook-enabled pools

3. Choose Pool – Select an LBAMM pool (e.g., USDT/USDC), Click “...” → Add Liquidity or click on the pool to view more details

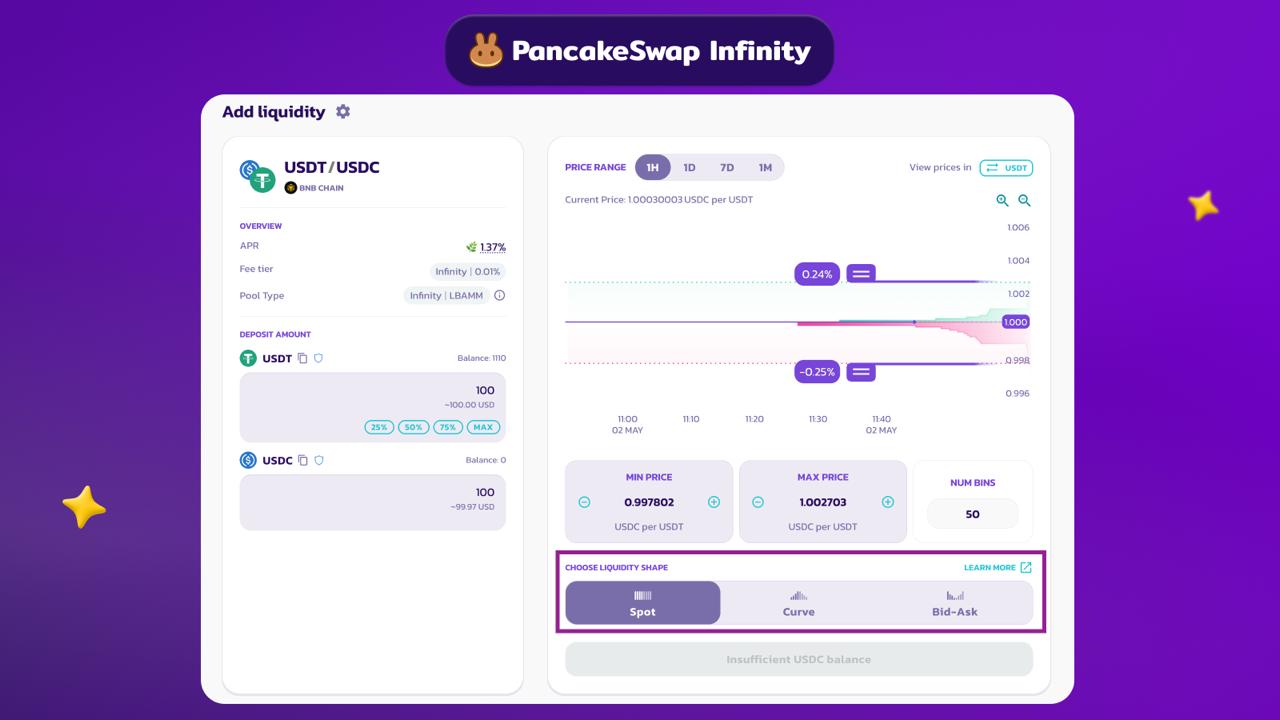

4. Enter Amounts – Input the amount for each token, select price range

5. Choose Liquidity Shape – Spot, Curve, or Bid-Ask

Select how you want to distribute your liquidity based on your market expectations:

- Spot – Distributes liquidity evenly across all price bins in selected range.

Ideal for balanced exposure and predictable coverage when market direction is uncertain.

- Curve – Concentrates more liquidity near the current price and tapers off further away.

Best when you expect low volatility and want to maximize fees from frequent trades near the market price.

- Bid-Ask – Places less liquidity near the current price and more further out.

Suited for high-volatility environments where you aim to capture fees from larger, directional price movements.

6. Confirm Transaction – Approve via your wallet

7. Receive LP Tokens – ERC-20 tokens will represent your position

2. Adding Liquidity to CLAMM (with Dynamic Fee Hook)

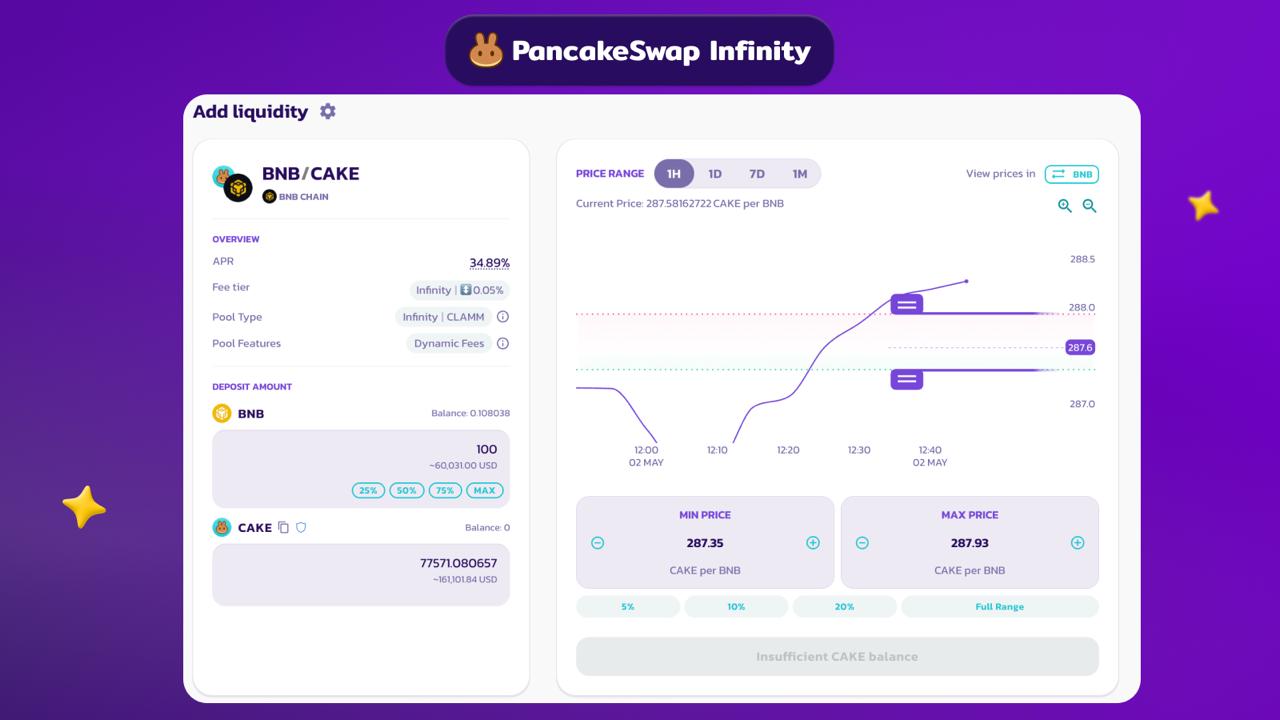

CLAMM pools let you provide liquidity in custom price ranges, offering high capital efficiency. This example uses a Dynamic Fee Hook, which adjusts fees automatically based on market conditions.

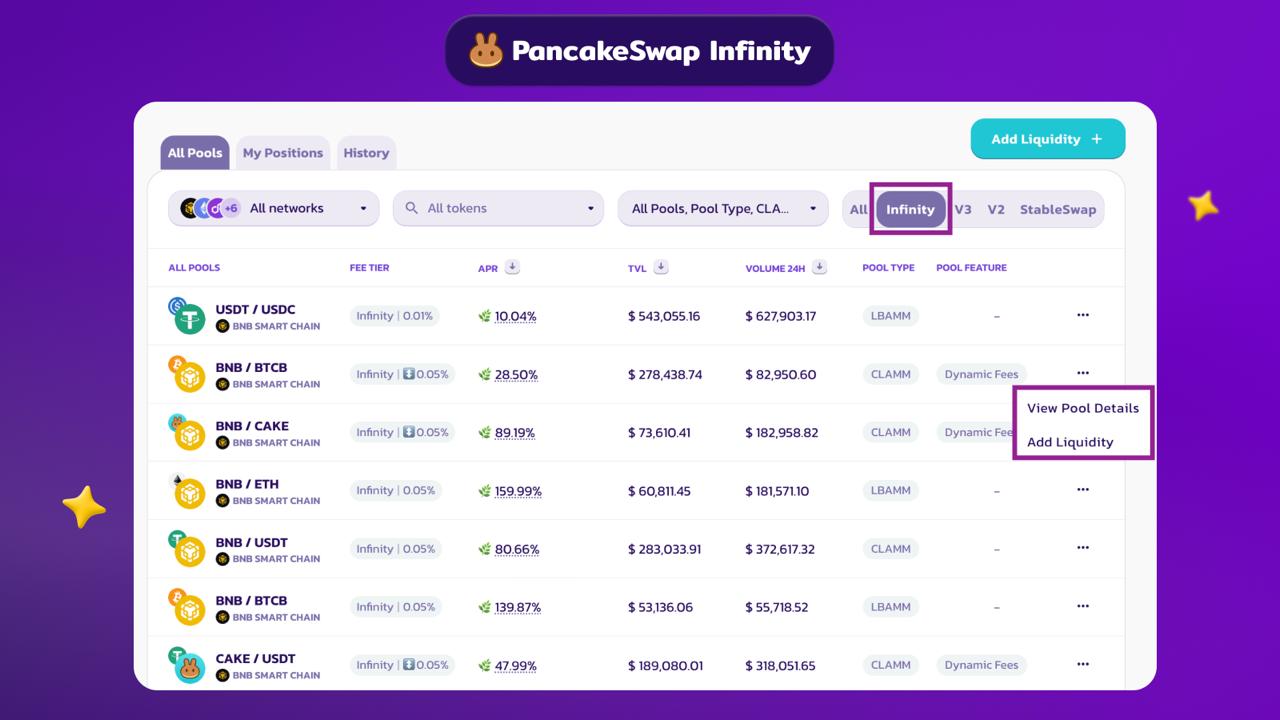

1. Go to Liquidity Page – Navigate to “Liquidity” and enable the “Infinity” tab.

2. Choose Pool – Select a CLAMM pool (e.g., BNB/CAKE with Dynamic Fee Hook), click “...” → “Add Liquidity”. or click on the pool to view more details

3. Input Token Amounts – Input the amount of each token, select price range

4. Confirm Transaction – Approve the transaction in your wallet.

5. Receive LP Tokens – You'll receive Non-fungible (NFT) representing your position.

Final Tips

- LP Earnings – You earn trading fees whenever your liquidity is used in a swap.

- Impermanent Loss – Active LPs should be mindful of the risk of impermanent loss, especially in volatile pairs.

- Infinity Hooks – You can enhance your liquidity strategy with hooks like the Dynamic Fee Hook for automated fee adjustment.

How to Farm on PancakeSwap

Farming on Infinity is seamless and requires no extra staking steps. Once you add liquidity to an eligible Infinity Pool, you automatically start earning trading fees and Farming rewards—if your position is in range.

1. Automatically Start Earning: Once your liquidity is added, you’ll automatically begin earning:

- Trading fees from swaps routed through your pool

- Farming rewards if your position is within the active trading range

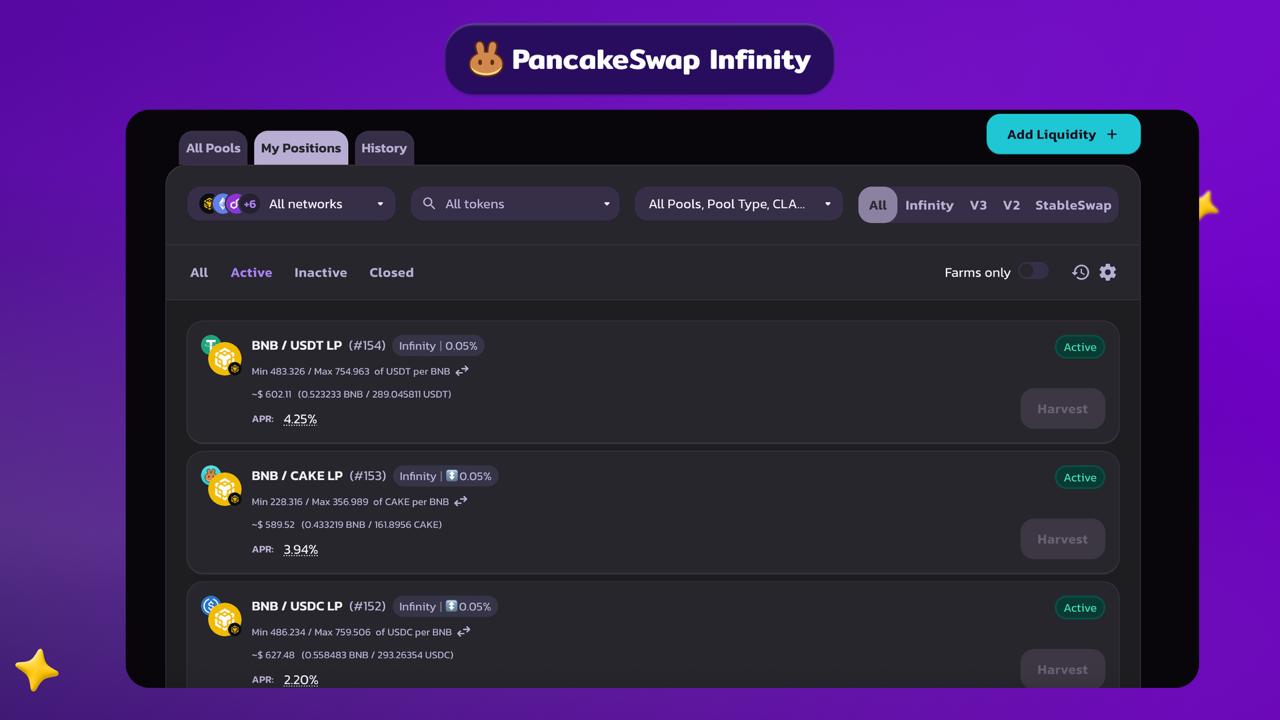

2. Track and Harvest Rewards

- Rewards are distributed (+ 1hr after dispute period ends) at the end of each epoch: 00:00 UTC, 08:00 UTC, 16:00 UTC

- Go to “My Positions” to view your earnings.

- Click “Harvest” to claim your Farming rewards after each epoch (8-hour cycle). (add same “Harvest All” info mentioned above)

- Rewards are proportional to the fees your position earns during that period.

- Unclaimed rewards roll over—no earnings are lost.

Farming Tip: Only in-range liquidity earns rewards. Monitor your position range to maximize returns. Learn more in the documentation

By choosing the pool type that suits your strategy, PancakeSwap Infinity gives you the tools to earn more efficiently from your crypto holdings. Whether you're providing passive liquidity through LBAMM or actively managing capital with CLAMM, Infinity delivers next-level control and rewards.

🧑🍳 Keep it ∞

— The Chefs