Dear Community,

Say hello to Linea! As the anticipation builds, we're thrilled to embrace another chain into our PancakeSwap lineage. With our growing multichain ecosystem, we now introduce Swap and Liquidity Provisioning features on Linea PancakeSwap at launch. In this step-by-step guide, we provide all you need to know from Bridging to Swap and Liquidity Provisioning.

How to connect your wallet on Linea PancakeSwap

Go to the top-right corner of your screen, choose Linea, and click "Connect Wallet". For those using browser extension wallets, you only need to select your wallet's icon and follow the instructions in the pop-up window.

If you need to transfer assets from other chains to Linea, please kindly visit here for the bridging instructions:https://blog.pancakeswap.finance/articles/how-to-bridge-tokens-from-eth-mainnet-to-linea

Swap on PancakeSwap v3 After Connecting to Linea

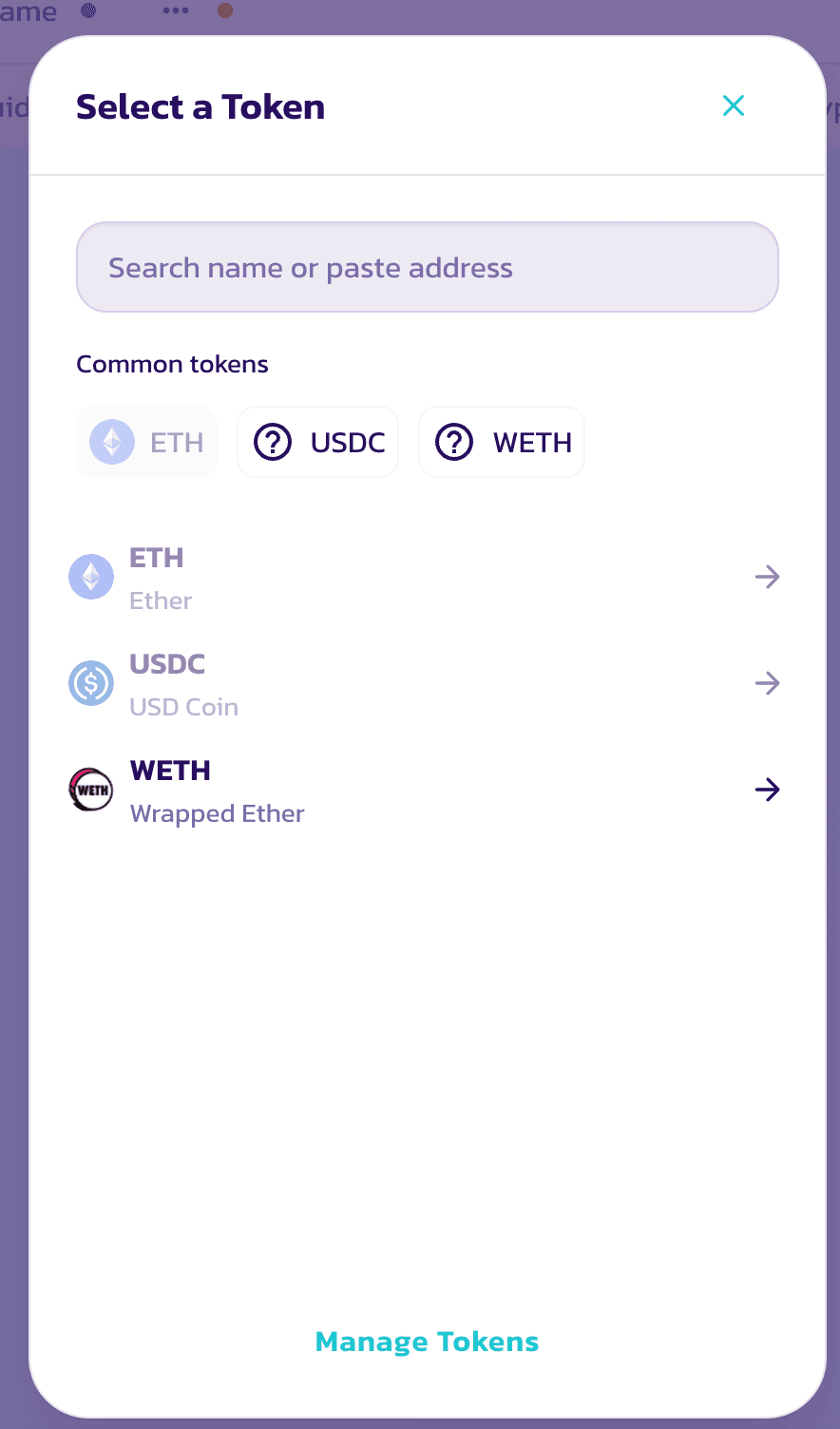

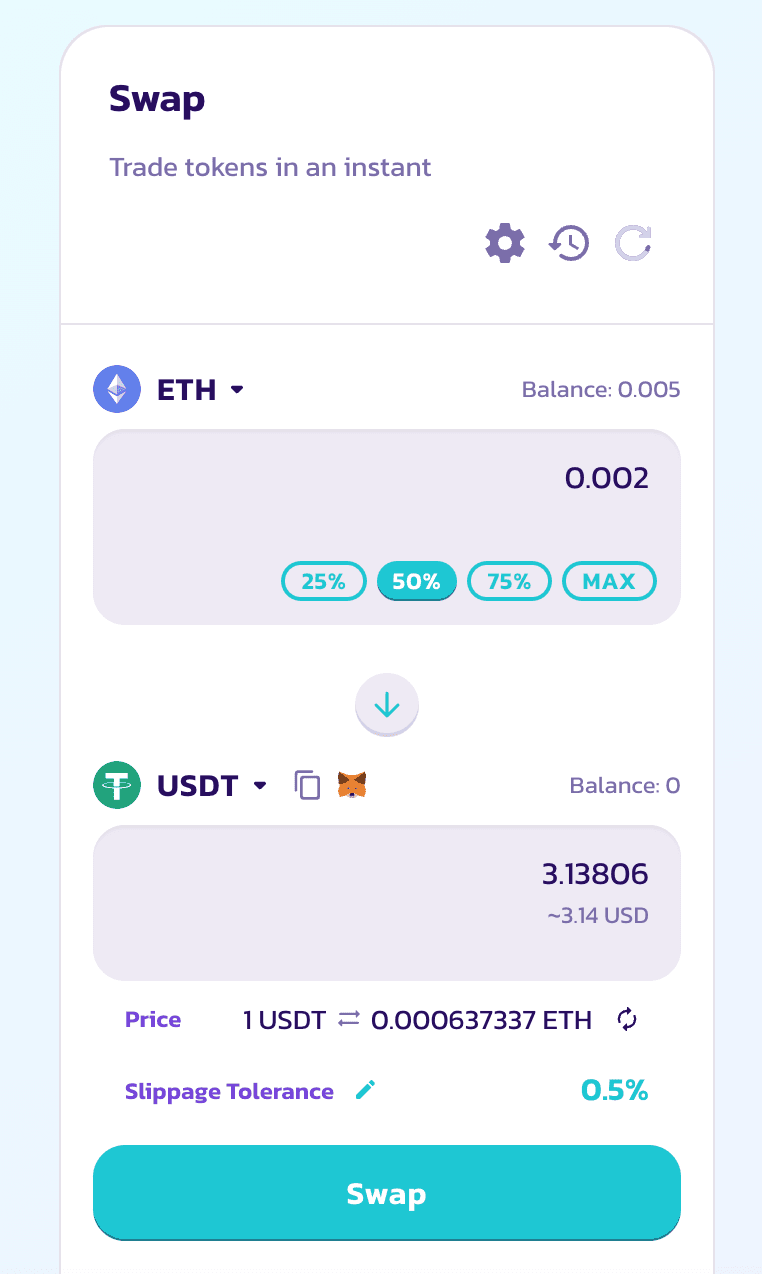

1. Choose the specific tokens you want to exchange and input the quantity.

2. Review all transaction information carefully. If everything looks good, press "Swap" to continue.

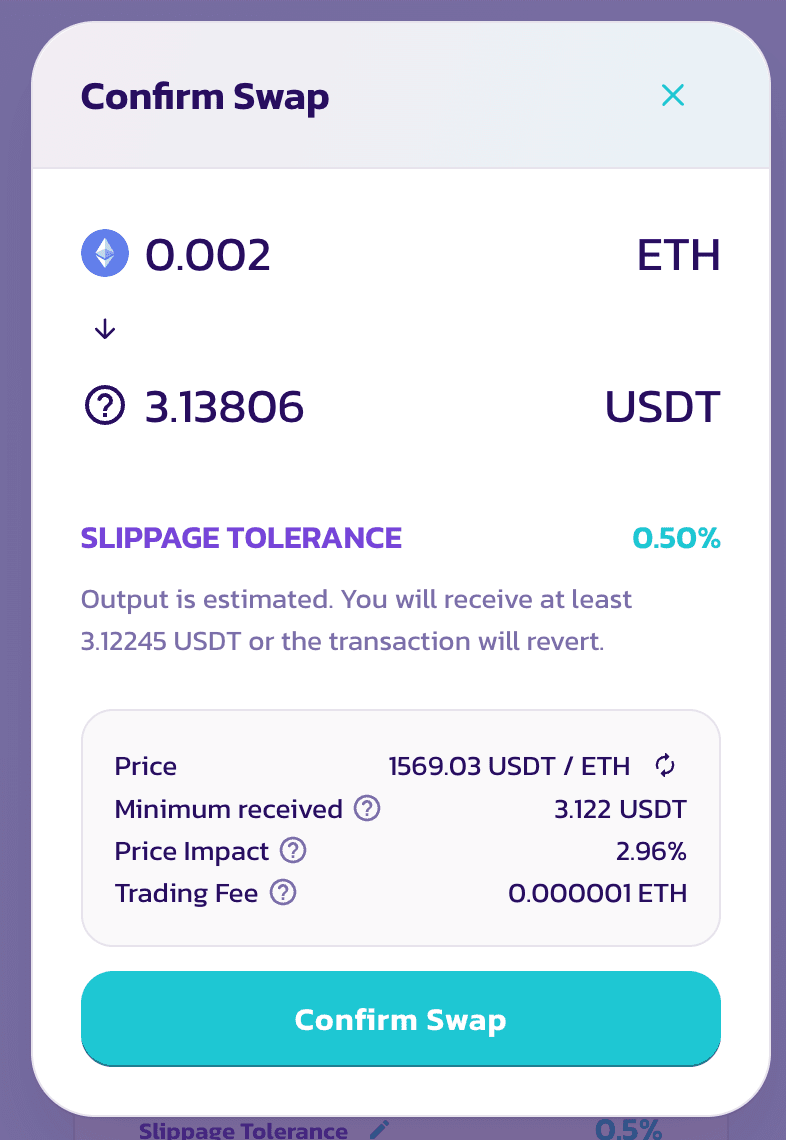

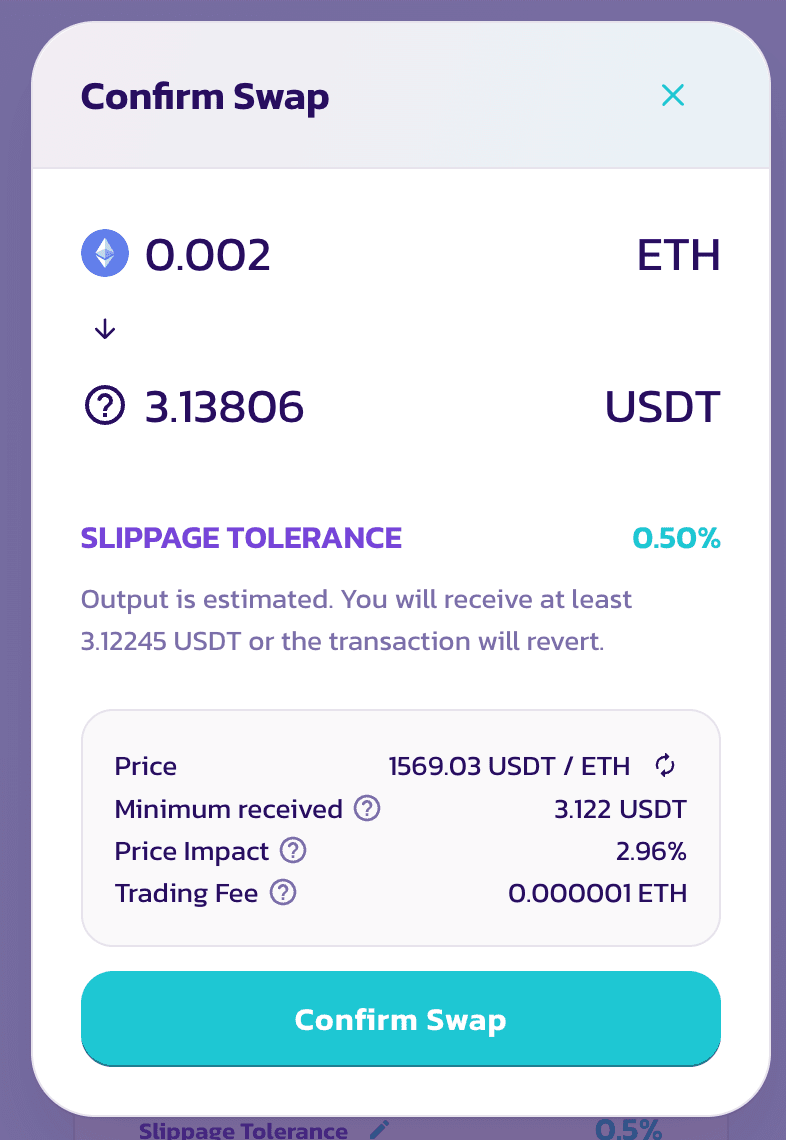

3.A prompt for "Confirm Swap" will appear. Review the details again for accuracy.

4. If all details are correct, proceed by clicking on the** "Confirm Swap"** button.

5. Your wallet will request one final transaction confirmation. Confirm to complete the process.

Add/Remove Liquidity in PancakeSwap v3 After Connecting to Linea

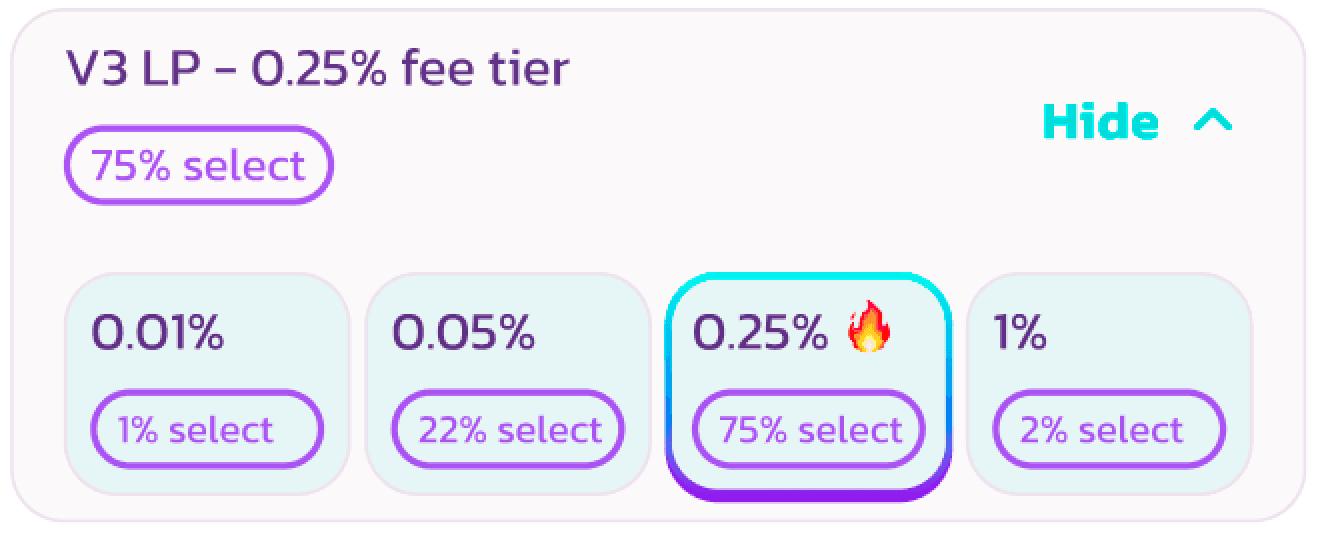

In v3, liquidity providers can focus their liquidity within a specific price range, allowing them to receive an equivalent amount of trading fee but with less capital committed to the liquidity pools. Also, providers can select from one of four trading fee tiers: 0.01%, 0.05%, 0.25%, and 1%. This feature is now available on Linea!

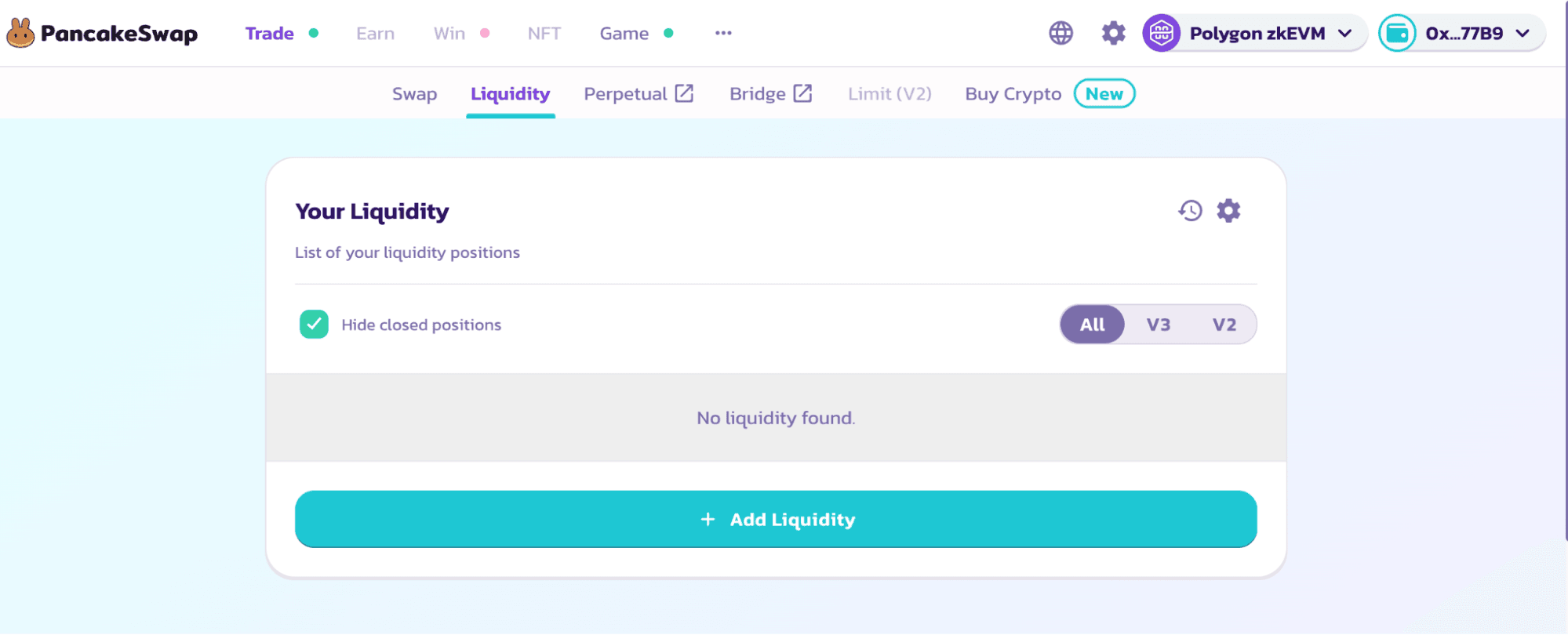

1. After connecting to Linea at the top right corner, navigate to the Liquidity page and select the "Add Liquidity" button.

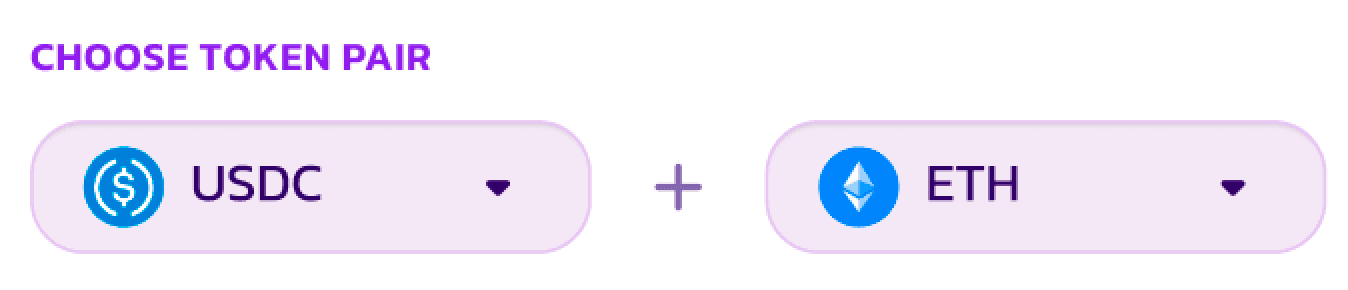

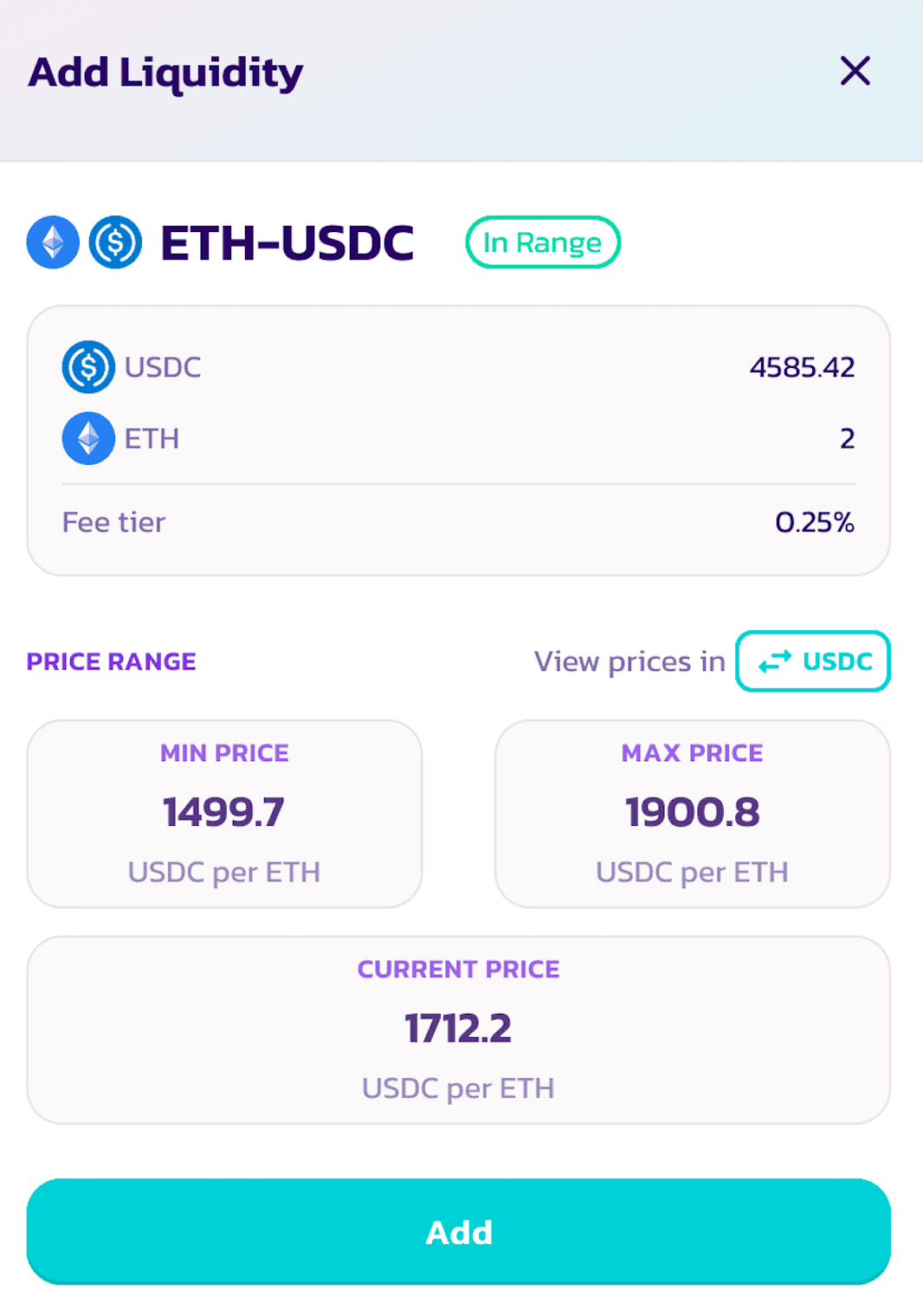

2. Choose the two tokens that will make up the trading pair for which you intend to add liquidity. In this example, we will use ETH and USDC.

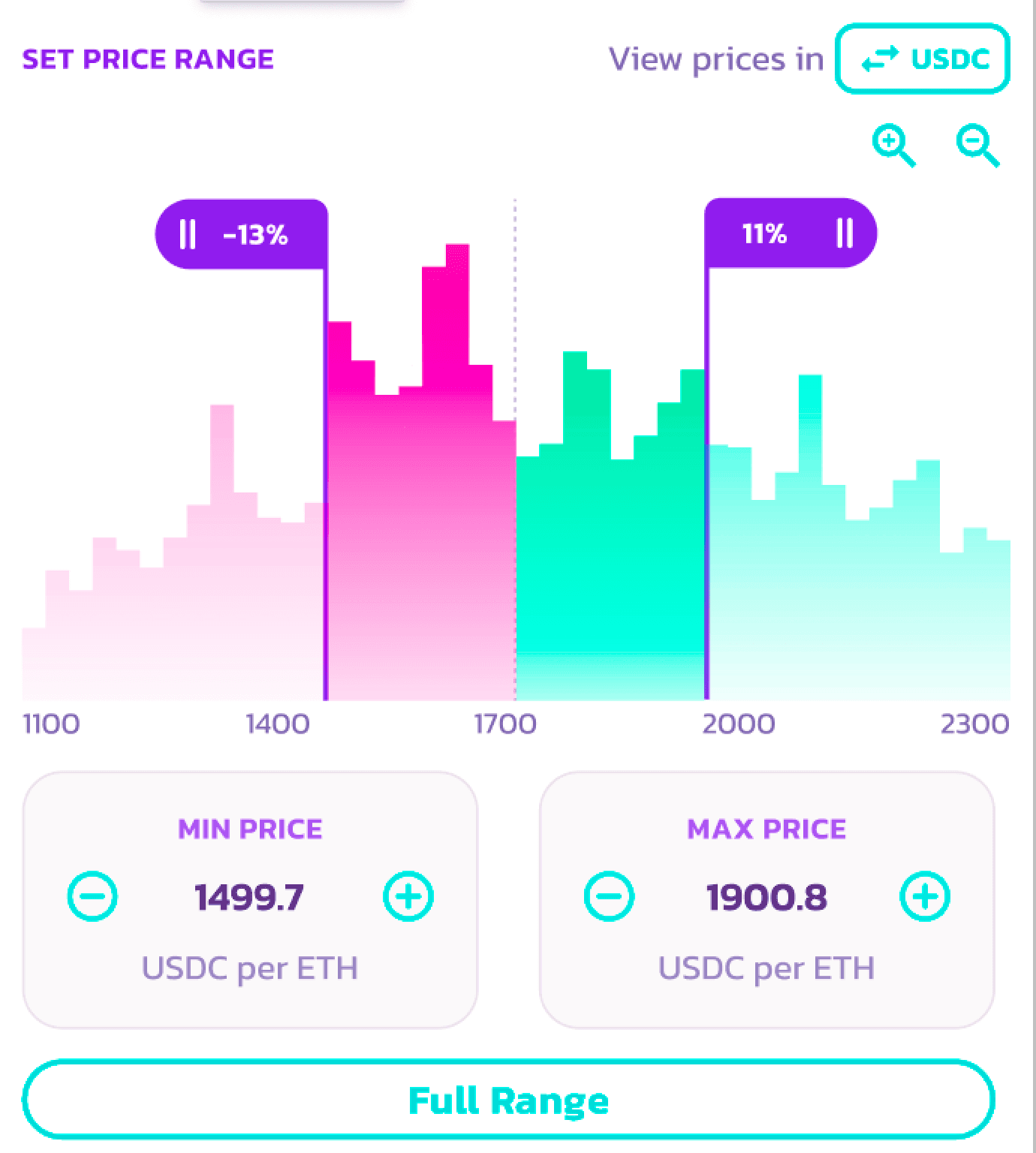

3. The system will automatically select the most widely-used trading fee tier and set your price range.

4-Ensure that you are adding v3 liquidity by checking for the "v3 LP" label.

5. The price range can be reviewed on the right side of the display. Adjustments can be made as needed. Please select an appropriate fee tier, as positions that are out-of-range will not generate trading fees.

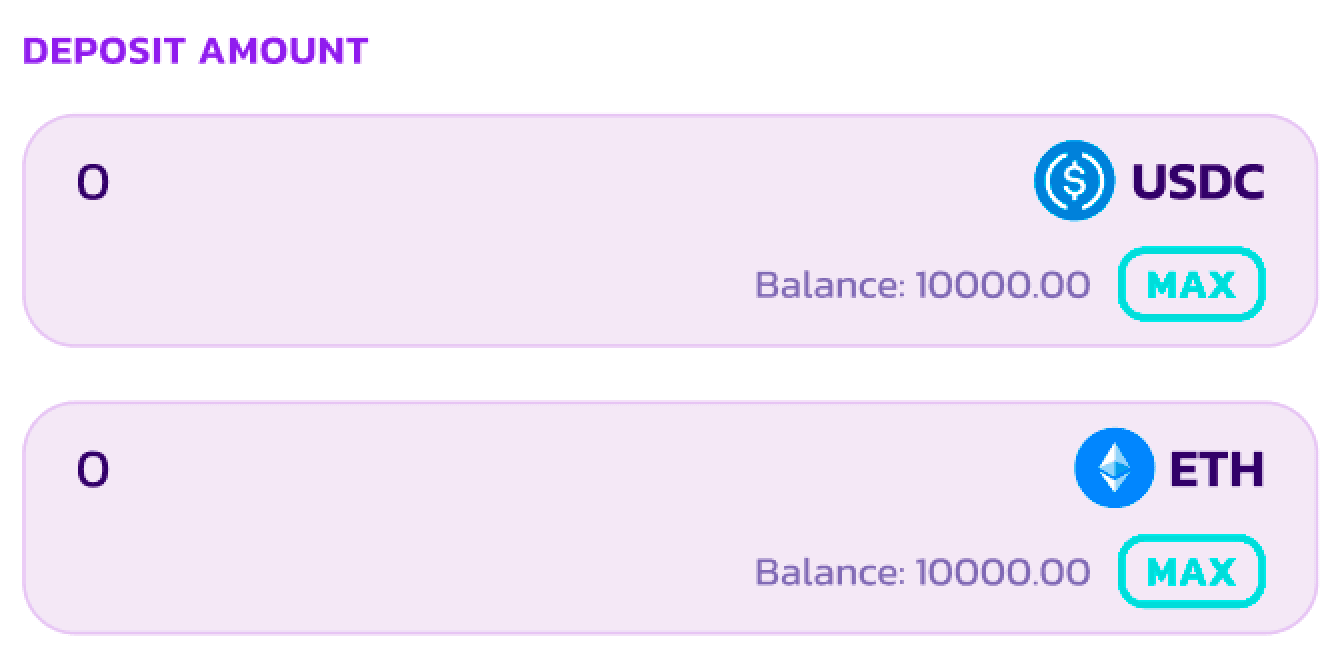

6. Enter a specific amount for one of the tokens in the "Deposit Amount" field, or simply use the "MAX" button for convenience.

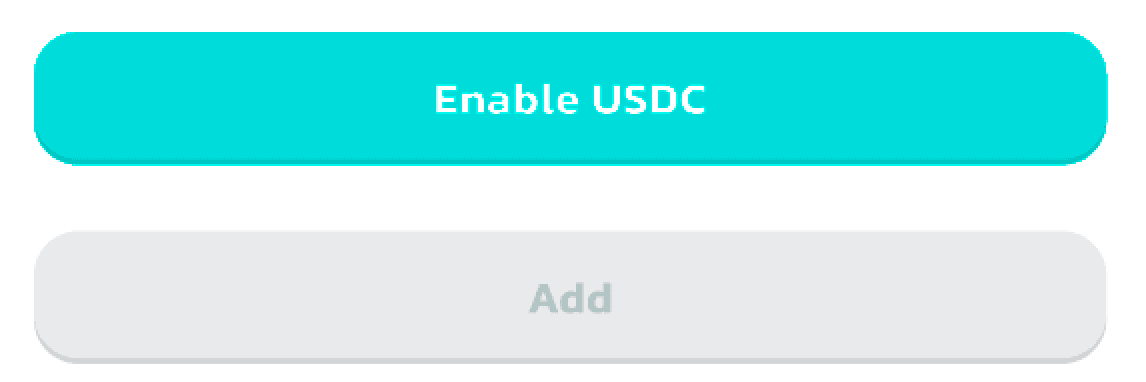

7. Click on the "Enable" button. If you add liquidity with tokens other than ETH, both tokens need to be enabled.

8. After completing these steps, the "Add" button will become active. Click on it to move forward.

9. A pop-up window will appear, providing a preview of your liquidity position. Review the details, and if everything is accurate, click "Add" once more to continue.

10. Your new liquidity position will be displayed on the "My Liquidity" page. Click on it to view the details.

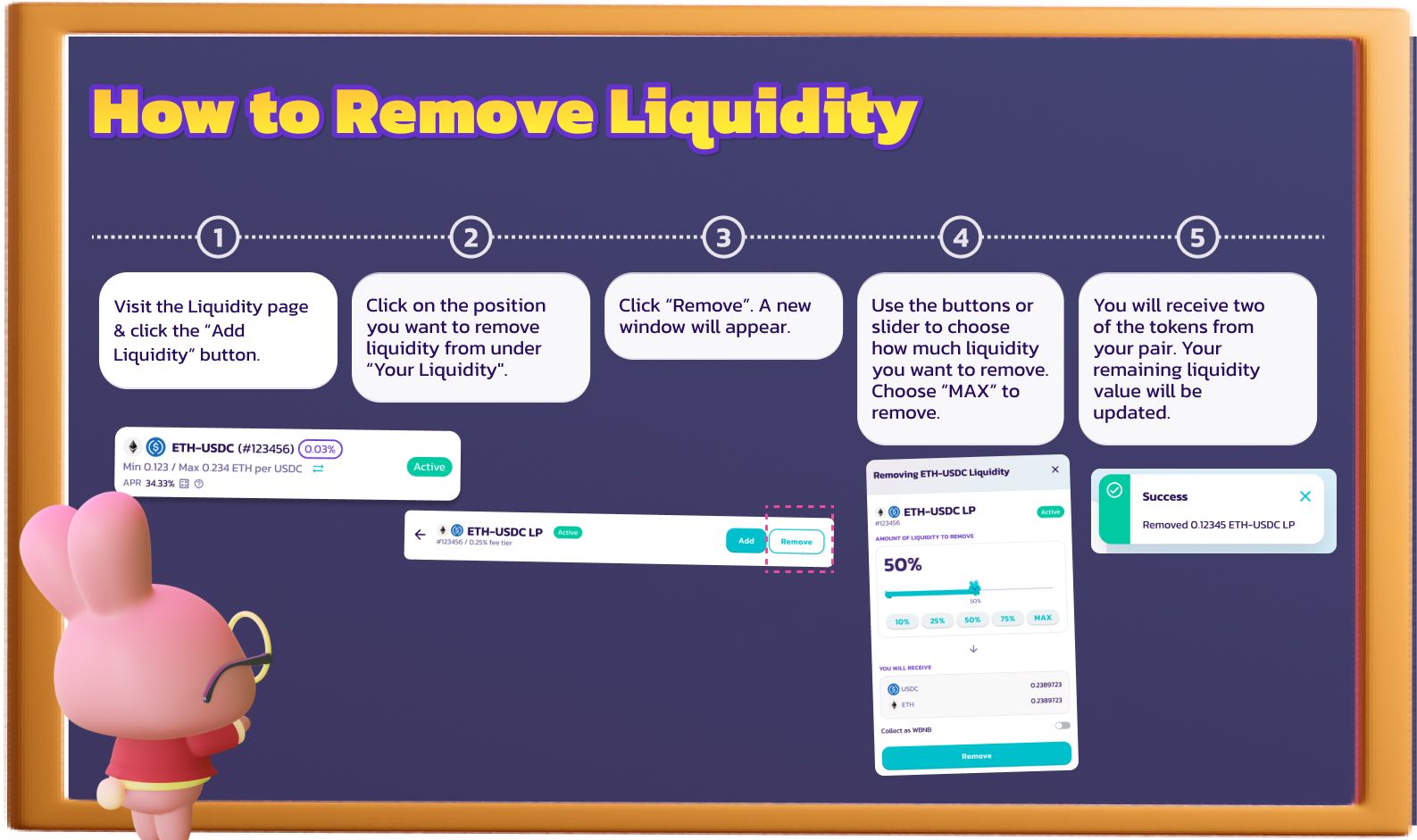

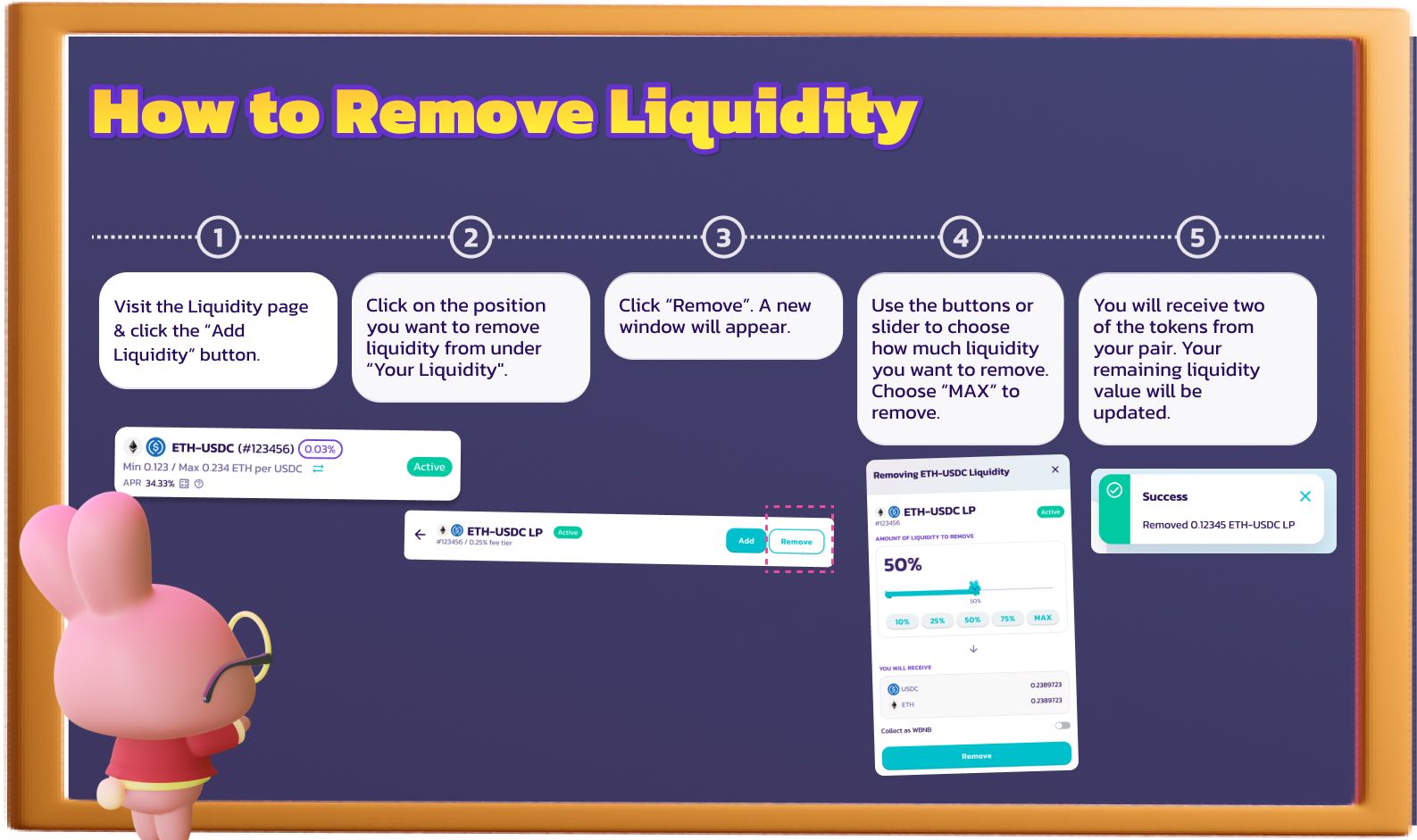

How to Remove Liquidity

- Navigate to the Liquidity page and select the "Add Liquidity" button.

- Identify the position from which you wish to remove liquidity under the "Your Liquidity" section, and select it.

- Select the "Remove" option. A new window will subsequently appear.

- Utilize either the buttons or the slider to determine the amount of liquidity you intend to withdraw. If you desire to remove all liquidity, simply select the "MAX" option.

- As a result of this action, you will receive both tokens from your pair. The value of your remaining liquidity will be updated accordingly.

Discover the comprehensive suite of features we provide to elevate your trading and liquidity support experience! But that's not all – prepare for an exhilarating "Traverse" expedition on the Linea island campaign hosted on Galxe, lasting seven weeks from 1:00 PM UTC on August 24th, 2023, to 1:00 PM UTC on October 12th, 2023. Dive into the Traverse campaign, where incredible treasures await your discovery!

🗺️ Happy adventure!

The Chefs 🥞