GM PancakeSwap community,

PancakeSwap is thrilled to announce our new partnership with Alpaca Finance! Alpaca Finance provides a variety of LP management solutions for our users. In this article, we will guide you on how to utilize their Automated Vaults (AV) strategies with different trading pairs, simplifying your liquidity provision on PancakeSwap v3.

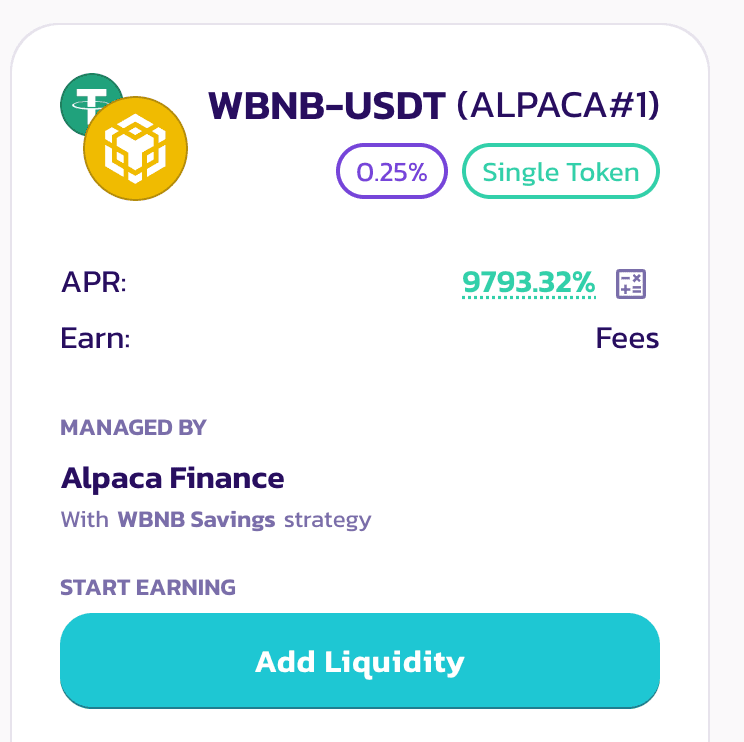

Initially, two vaults will be available: BTCB-ETH and BNB-USDT on the BNB Chain PancakeSwap. Let's explore how to maximize your returns according to your risk tolerance using this sophisticated strategy.

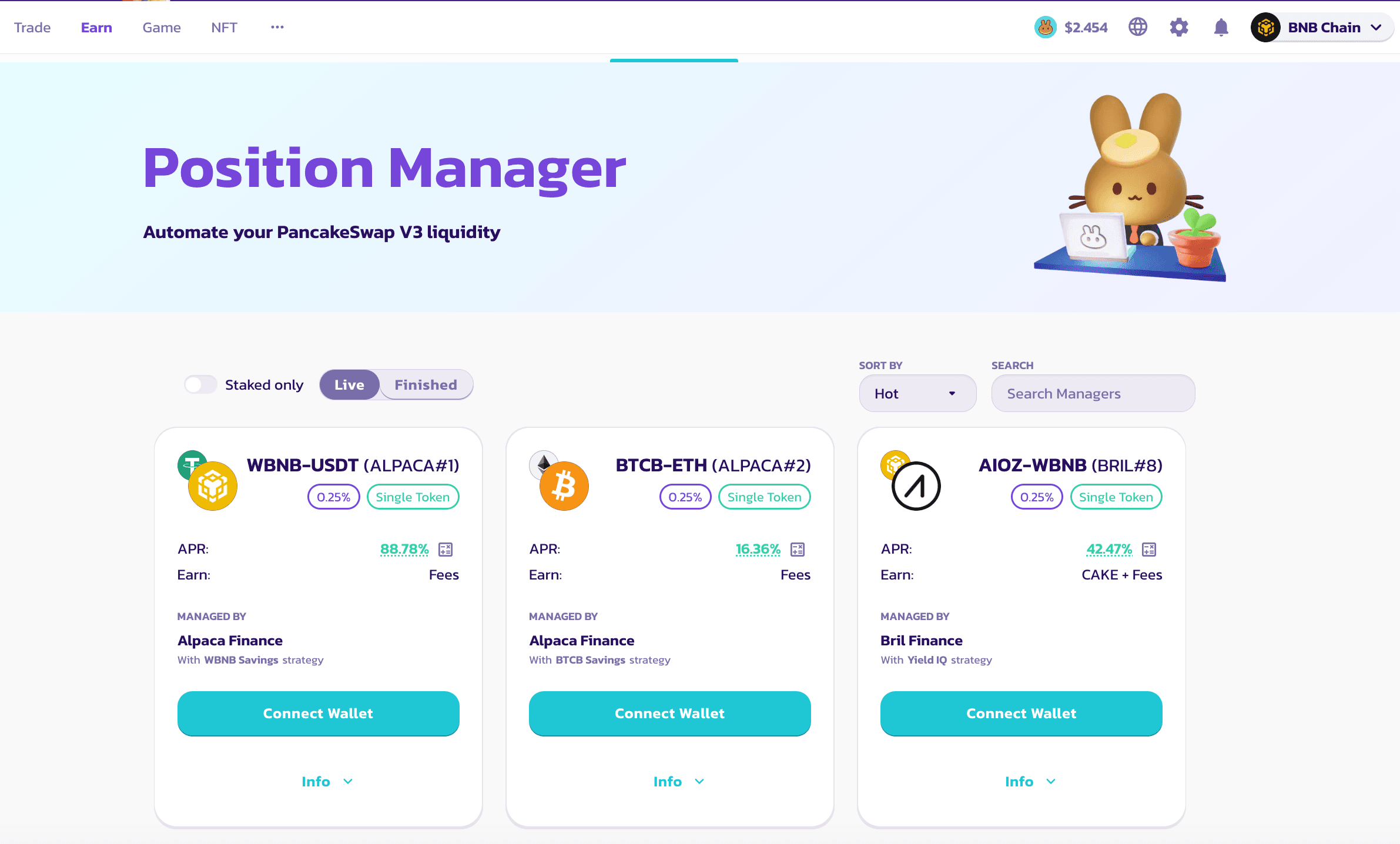

Quick Access: Position Manager Page**

About Alpaca Finance’s Automated Vaults (AV)

Alpaca Finance provides a suite of on-chain leverage products, which improve capital efficiency and subsequent returns. Alpaca Finance's Automated Vaults are tools that use advanced strategies to manage and grow your assets with minimal risk, similar to a digital hedge fund.

There are two main strategies for Automated Vaults: the Market-Neutral Strategy and the Savings Strategy.

Market-Neutral Strategy: This is a strategy where you can farm high returns with less risk, achieved by eliminating the majority of market risk to attain neutral exposure. It works by balancing your investment to reduce exposure to market changes. In simple terms, it aims to give high returns with low risk.

Savings Vault Strategy: This strategy is like staking your cryptocurrency (e.g., ETH, BTC, BNB) but with potentially higher returns, compared to lending or staking. The Automated Vault achieves this by optimally borrowing different assets with a target of 1xLong exposure and rebalancing it to eliminate liquidation risk. Meanwhile, your cryptocurrency earns fees and rewards from liquidity provision.

How Alpaca Finance’s strategies work on PancakeSwap v3

Alpaca Finance’s vaults open leveraged yield farming positions on PancakeSwap v3 by borrowing assets from Alpaca Finance’s lending pools. Through this mechanism, depositors gain improved capital efficiency and a higher multiplier on APYs.

Each strategy has a given target exposure (neutral for Market-Neutral Vaults, and 1x long for Savings Vaults), and the strategies maintain exposure near the target over time through hedging and rebalancing. The ultimate goal of rebalancing is to eliminate the delta exposure of Automated Vaults due to changes in asset prices (aka hedging). We have Intelligence Factors in the system to determine when and how to rebalance, which work to increase the aggregate long-term profitability.

Depending on the market condition, there is a specific optimal hedging strategy that will provide the highest potential returns for AVs. For example, if the market is volatile but the price is range bound, the optimal strategy would be to hold off any rebalancing TX, as one would otherwise be cementing the IL and paying for the TX costs unnecessarily as price oscillates in the range. On the other hand, if the market is trending in one direction, the best course of action would be to execute the rebalance gradually over the price range as it moves, because waiting too late to execute would result in higher IL and loss in this case.

The current rebalancing system leverages many data points including historical prices and various economic factors to develop signals which can determine, with a high probability, which market regime price is currently in (trending or range bound; will there be a reversion). As the model gathers real-life operation data points, it also utilizes machine learning to improve its performance over time. Based on this information, the hedging algorithm would adjust its behavior (i.e., “operating mode”) based on what’s optimal at the time.

We also use probabilistic execution to help prevent a potential manipulator from reverse engineering the exact rules of execution. So to outside observers, the transaction timing could look less deterministic. For more information on how our hedging mechanics works, please refer to these docs.

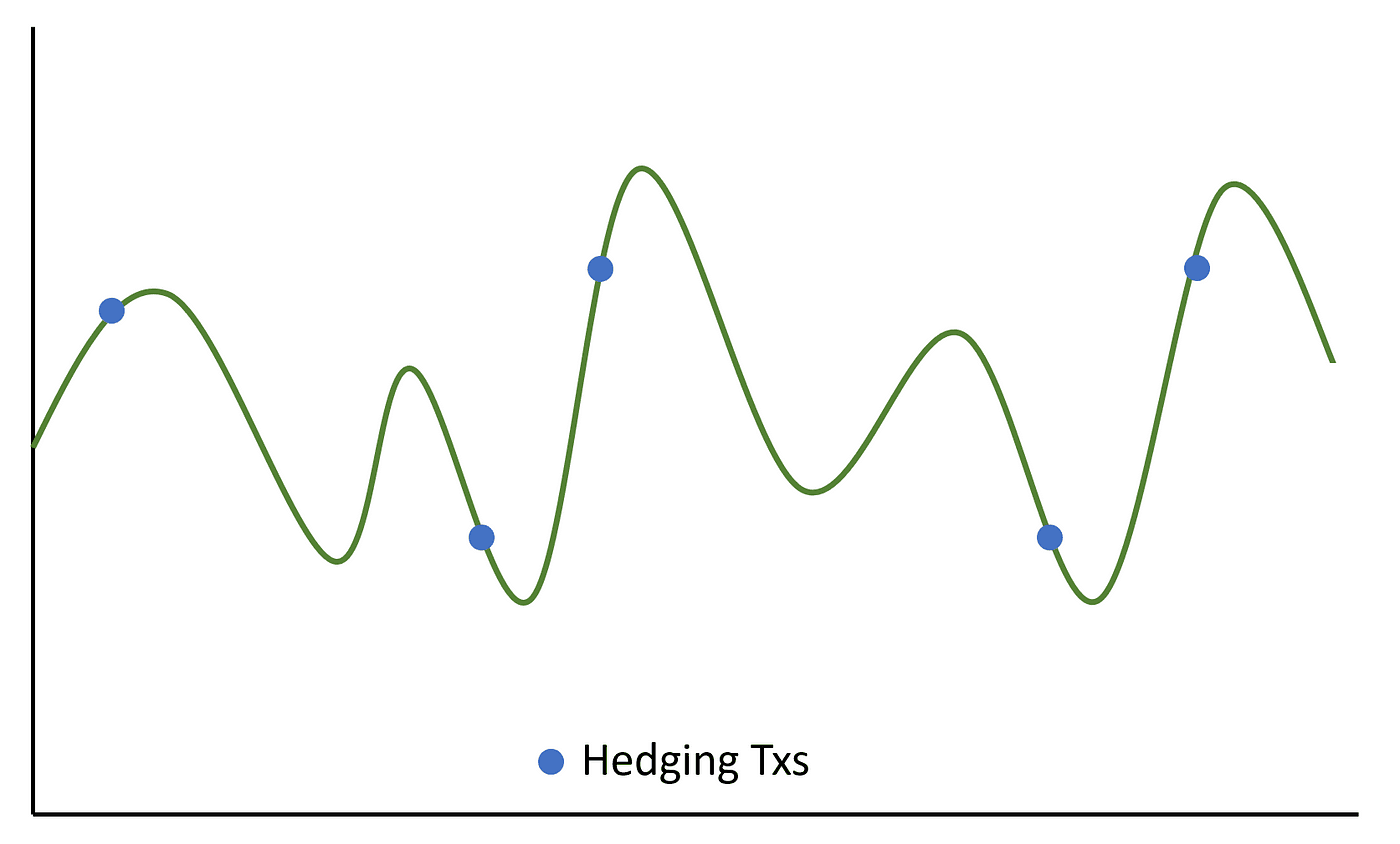

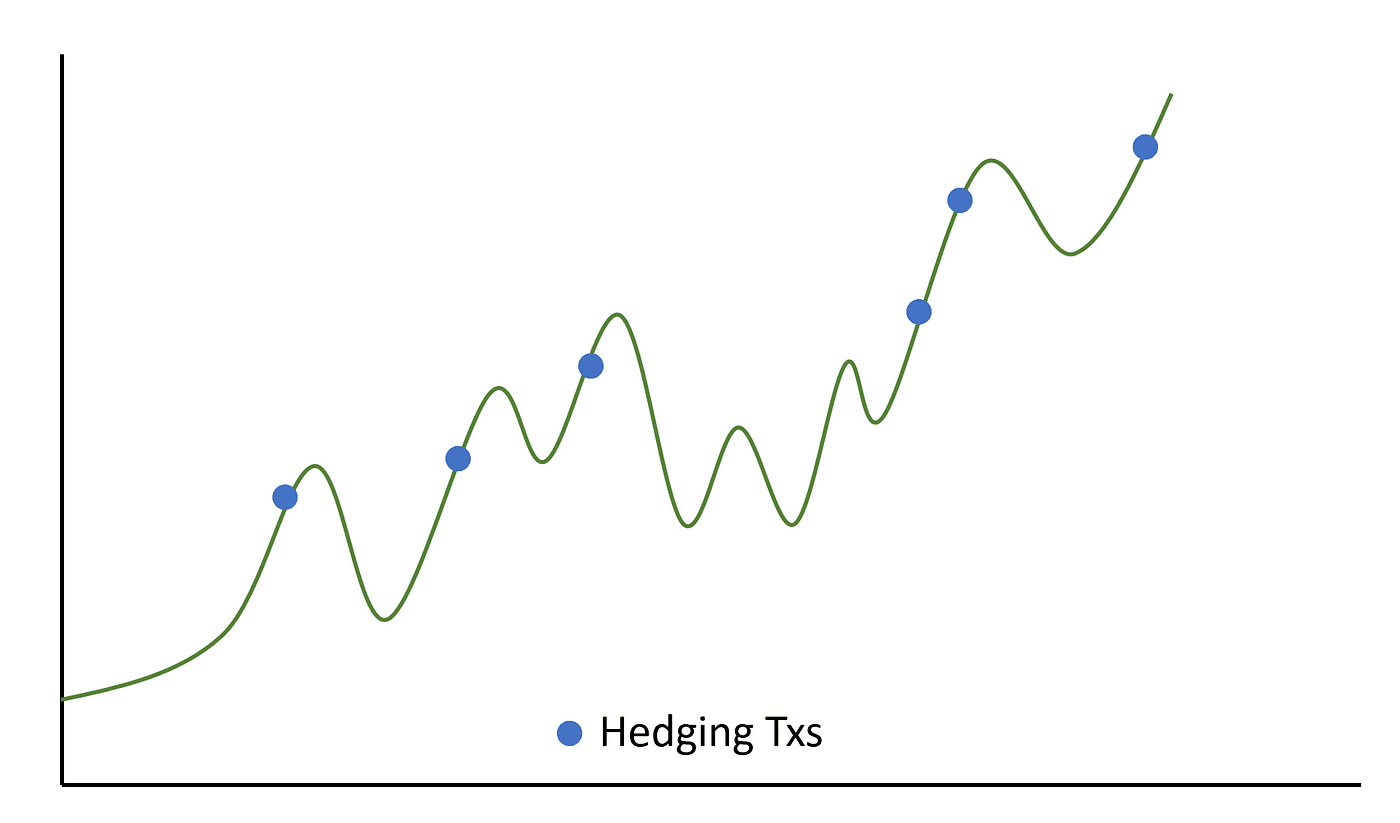

Examples of what hedging operations can look like in various market conditions:

Example1: Hedging closely

- This mode is activated when price momentum is expected, but the direction of the movement is unknown.

- This means the rebalancing would happen in either direction of the price move. By hedging closely, the vaults’ delta exposure is kept close to zero and will have no bias for upcoming price movements.

Example2: Hedging Trends

- In this mode, the algorithm believes that there is a high probability of price trending in a particular direction.

- It will hedge the price movement closely, similar to Mode2. However, the hedge will only be one way in expectation of price moving in that direction.

- A move in the other direction would not be hedged, due to anticipation of reversion.

Savings Vaults are always generating passive income for you, with 0 possibility of liquidation due to how the Vaults automate risk management. Furthermore, Savings Vaults also auto-compound your yields, making it a product you can deposit into and not have to actively manage it. In fact, you won’t need to do anything except watch as the number of crypto tokens in your portfolio grows.

How to use Position Manager on PancakeSwap with Alpaca Finance’s strategies

1. Visit our Position Manager Page

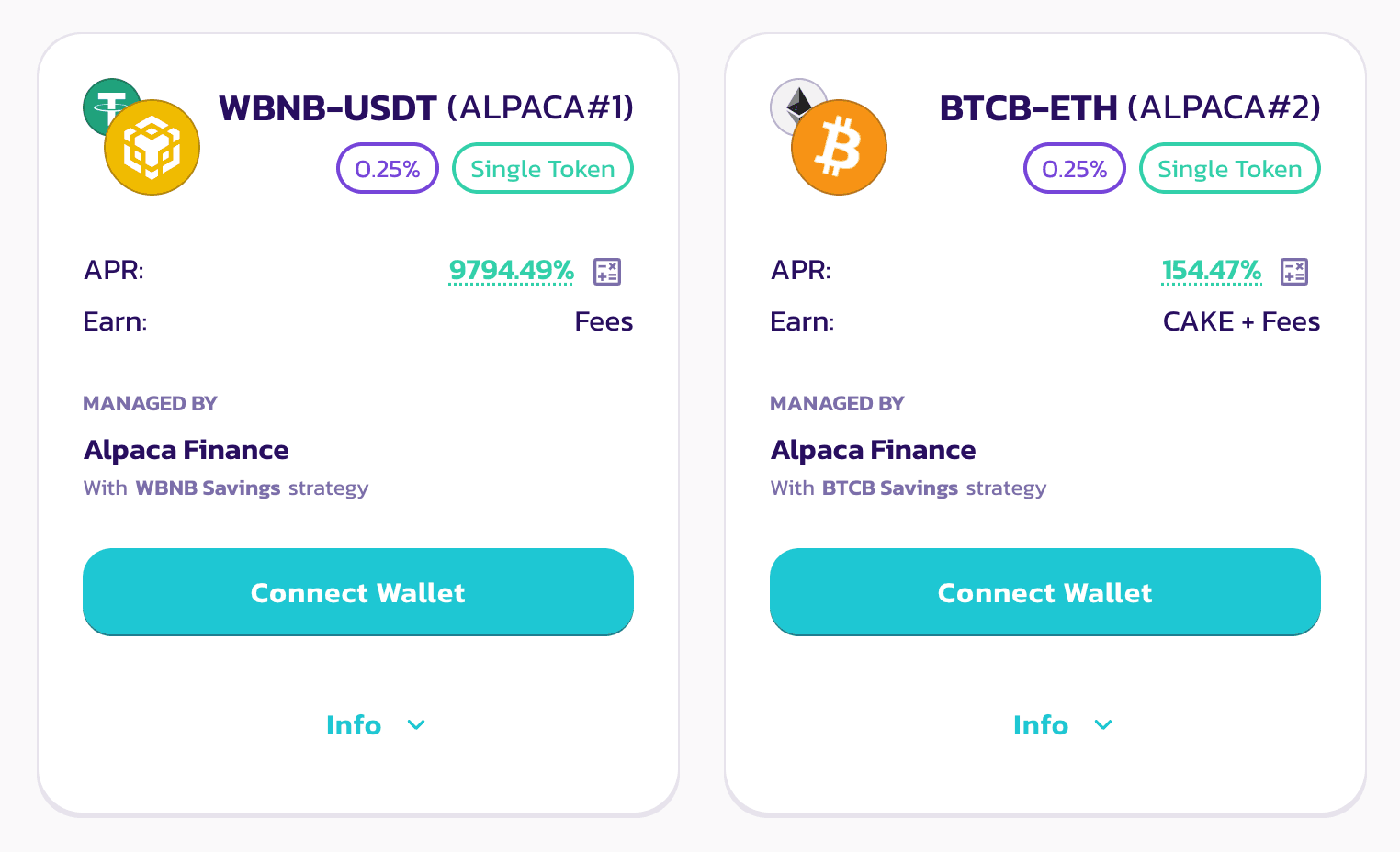

2: In this case, we'll choose the pairs marked as "managed by Alpaca Finance' to try out their strategies.

2: In this case, we'll choose the pairs marked as "managed by Alpaca Finance' to try out their strategies.

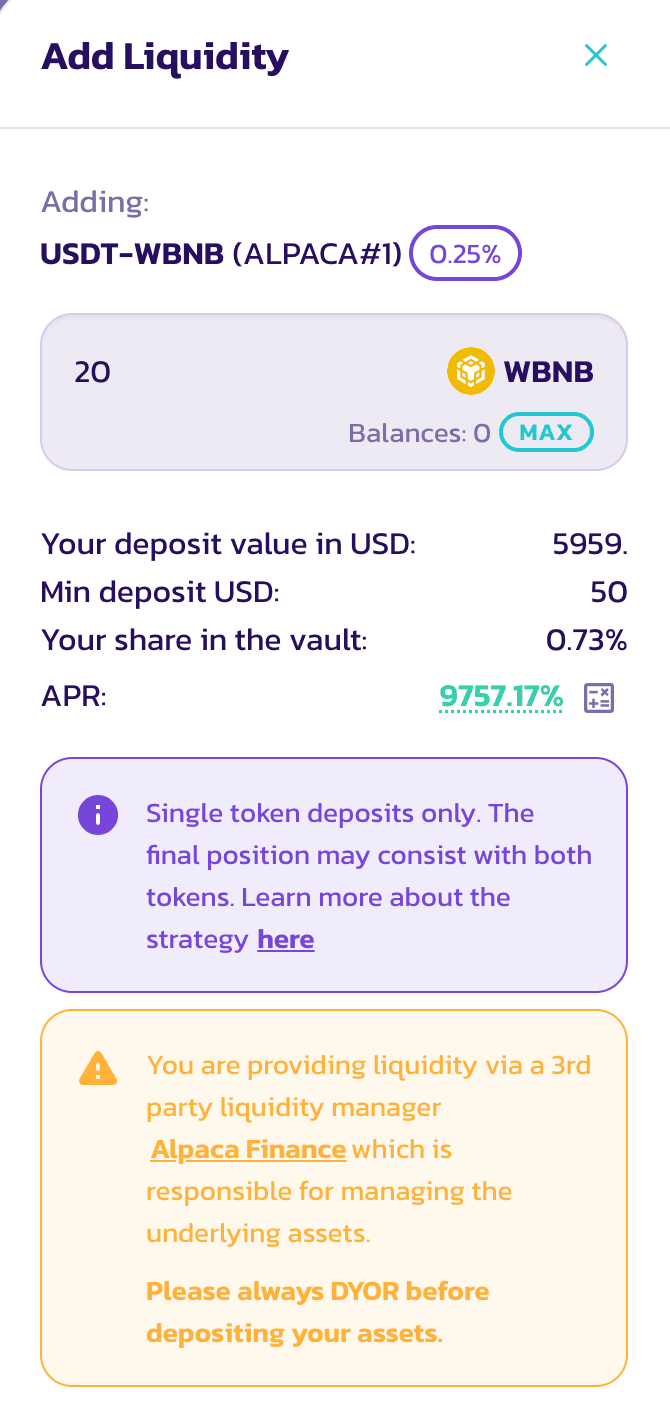

3: Once you've chosen the trading pair with its respective strategy, click on the "Add Liquidity" tab.

4:A dropdown will appear displaying the needed deposit token, info about APR, and the management fee for the strategy provider. Specify the quantity of the token you wish to deposit and then "Approve [Token]"

5: Review the details once more, and then click "Confirm".

Enhance Your Experience with PancakeSwap's Position Manager

PancakeSwap's Position Manager is designed to simplify the liquidity provisioning process for LPs, aiming to reduce losses and increase profits. For more details about its features and our collaborations, check out our Position Manager announcement blog.

Enjoy!

The Chefs